Page 739 - Insurance Statistics 2021

P. 739

Indian Non-life Insurance Industry

Yearbook 2018-19

Chart 3.12.2

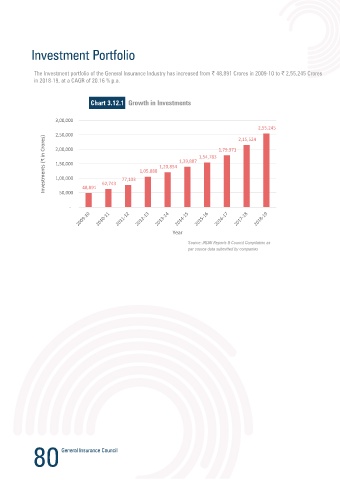

The Investment portfolio of the General Insurance Industry has increased from 48,891 Crores in 2009-10 to 2,55,245 Crores 75,000 68,031

in 2018-19, at a CAGR of 20.16 % p.a.

59,536

60,000

51,973

Chart 3.12.1 45,000 39,031 43,026

₹ in Crores 33,820

3,00,000

2,55,245 30,000 11,876 15,233 19,136 26,482

2,50,000

Investments (₹ in Crores) 2,00,000 77,103 1,05,888 1,20,854 1,39,887 1,54,783 1,79,371 15,000

2,15,524

1,50,000

-

1,00,000

62,743

48,891

Year

50,000

Source: IRDAI Reports & Council Compilation as

-

per source data submitted by companies

Year

Source: IRDAI Reports & Council Compilation as The Non-Life Insurance Industry has generated an operating loss for 2018-19 amounting to 3563 Crores after allocation of

per source data submitted by companies

Investment income pertaining to policyholders.

Chart 3.13.1

24,000

19,986 20,453

16,322

14,169

14,000 10,514 12,429

9,088

6,676 7,056

5,372

₹ in Crores (1,026) 1,296 2,743 1,638 4,036

4,000

(987)

(2,215)

(6,000)

(3,385)

(5,012) (3,563)

(6,398) (7,792) (7,771)

(10,062) (9,271) (10,792) (15,156) (15,950)

(16,000)

(24,016)

(21,334)

(26,000)

Year

Investment Income Pure underwriting losses Operating Profits

Source: IRDAI Reports & Council Compilation as

per source data submitted by companies

80 81