Page 754 - Insurance Statistics 2021

P. 754

Indian Non-life Insurance Industry

Yearbook 2018-19

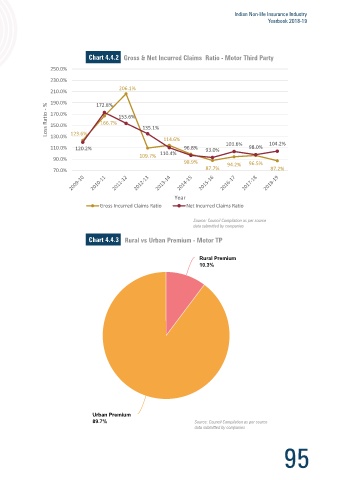

Motor Third Party Chart 4.4.2 Gross & Net Incurred Claims Ratio - Motor Third Party

250.0%

The Motor TP rates are administered by the IRDAI. The same is reviewed on a periodical basis

230.0%

206.1%

210.0%

Table 4.4.1 Motor TP

190.0%

% 172.8%

Loss Ratio - 166.7%

2018-19 Value 170.0% 153.6%

No. Of TP Policies( Under Package) 8,28,79,322 150.0% 135.1%

No. Of Standalone TP Policies 2,80,19,435 130.0% 123.6%

114.6%

103.6% 104.2%

Premium (in Cr) 38,035 110.0% 120.2% 96.8% 93.0% 98.0%

110.4%

No. Of Claims Reported 4,46,173 90.0% 109.7%

98.9% 94.2% 96.5%

No. Of Paid Claims 4,06,863 70.0% 87.7% 87.2%

Amt of Paid Claims (in Cr) 16,730

Premium booked in India considered

Year

Chart 4.4.1 GDPI - Motor Third Party Gross Incurred Claims Ratio Net Incurred Claims Ratio

Source: Council Compilation as per source

42,000 data submitted by companies

38,046

36,000 32,935 Chart 4.4.3 Rural vs Urban Premium - Motor TP

30,000

Rural Premium

26,573 Rural Premium

10.3%

10.3%

₹ in Crores 18,000 17,615 21,036

24,000

12,460 15,237

12,000 9,679

5,573 6,355

6,000

-

Year

Source: Council Compilation as per source

data submitted by companies

Urban Premium

Urban Premium

89.7%

89.7% Source: Council Compilation as per source

data submitted by companies

94 95