Page 44 - CAREPOINT GLOBAL BUSINESS PLAN

P. 44

CarePoint Global Business Plan

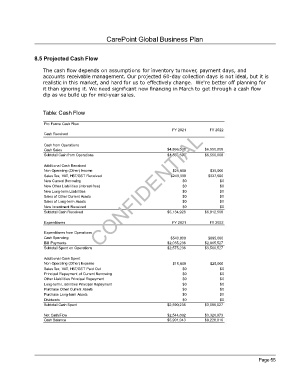

8.5 Projected Cash Flow

The cash flow depends on assumptions for inventory turnover, payment days, and

accounts receivable management. Our projected 60-day collection days is not ideal, but it is

realistic in this market, and hard for us to effectively change. We're better off planning for

it than ignoring it. We need significant new financing in March to get through a cash flow

dip as we build up for mid-year sales.

Table: Cash Flow

Pro Forma Cash Flow

FY 2021 FY 2022

Cash Received

Cash from Operations

Cash Sales $4,866,598 $6,550,000

Subtotal Cash from Operations $4,866,598 $6,550,000

Additional Cash Received

Non Operating (Other) Income $25,000 $35,000

Sales Tax, VAT, HST/GST Received $243,330 $327,500

New Current Borrowing $0 $0

New Other Liabilities (interest-free) CONFIDENTIAL $0

$0

New Long-term Liabilities $0 $0

Sales of Other Current Assets $0 $0

Sales of Long-term Assets $0 $0

New Investment Received $0 $0

Subtotal Cash Received $5,134,928 $6,912,500

Expenditures FY 2021 FY 2022

Expenditures from Operations

Cash Spending $540,000 $695,000

Bill Payments $2,035,236 $2,865,527

Subtotal Spent on Operations $2,575,236 $3,560,527

Additional Cash Spent

Non Operating (Other) Expense $15,000 $25,000

Sales Tax, VAT, HST/GST Paid Out $0 $0

Principal Repayment of Current Borrowing $0 $0

Other Liabilities Principal Repayment $0 $0

Long-term Liabilities Principal Repayment $0 $0

Purchase Other Current Assets $0 $0

Purchase Long-term Assets $0 $0

Dividends $0 $0

Subtotal Cash Spent $2,590,236 $3,585,527

Net Cash Flow $2,544,692 $3,326,973

Cash Balance $5,901,043 $9,228,016

Page 55

CarePoint Global Business Plan +966 55 119 6445