Page 47 - CAREPOINT GLOBAL BUSINESS PLAN

P. 47

CarePoint Global Business Plan

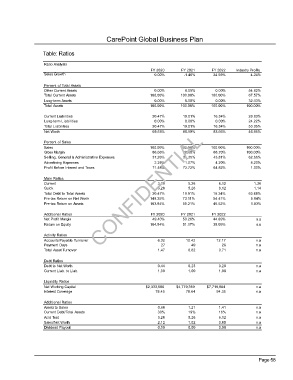

Table: Ratios

Ratio Analysis

FY 2020 FY 2021 FY 2022 Industry Profile

Sales Growth 0.00% -1.46% 34.59% 4.24%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 54.82%

Total Current Assets 100.00% 100.00% 100.00% 67.57%

Long-term Assets 0.00% 0.00% 0.00% 32.43%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 30.47% 19.01% 16.34% 28.83%

Long-term Liabilities 0.00% 0.00% 0.00% 24.22%

Total Liabilities 30.47% 19.01% 16.34% 53.05%

Net Worth 69.53% 80.99% 83.66% 46.95%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 86.66% 88.60% 88.70% 100.00%

Selling, General & Administrative Expenses 37.26% 38.35% 43.81% 62.66%

Advertising Expenses 2.25% 1.07% 4.20% 8.20%

Profit Before Interest and Taxes 71.48% 72.72% 64.82% 1.00%

Main Ratios

Current 3.28 5.26 6.12 1.36

3.28

Quick CONFIDENTIAL 5.26 6.12 1.14

Total Debt to Total Assets 30.47% 19.01% 16.34% 63.68%

Pre-tax Return on Net Worth 149.35% 73.11% 54.41% 5.04%

Pre-tax Return on Assets 103.84% 59.21% 45.52% 1.83%

Additional Ratios FY 2020 FY 2021 FY 2022

Net Profit Margin 49.40% 50.26% 44.89% n.a

Return on Equity 104.54% 51.17% 38.09% n.a

Activity Ratios

Accounts Payable Turnover 6.32 10.42 12.17 n.a

Payment Days 27 49 26 n.a

Total Asset Turnover 1.47 0.82 0.71 n.a

Debt Ratios

Debt to Net Worth 0.44 0.23 0.20 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $2,333,586 $4,779,359 $7,719,884 n.a

Interest Coverage 78.45 78.64 94.35 n.a

Additional Ratios

Assets to Sales 0.68 1.21 1.41 n.a

Current Debt/Total Assets 30% 19% 16% n.a

Acid Test 3.28 5.26 6.12 n.a

Sales/Net Worth 2.12 1.02 0.85 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Page 58

CarePoint Global Business Plan +966 55 119 6445 [Type here]