Page 10 - Summit BHC 2022 Benefits Guide Summit Corporate

P. 10

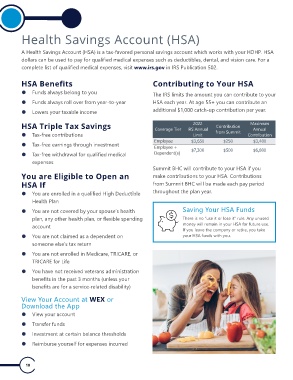

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-favored personal savings account which works with your HDHP. HSA

dollars can be used to pay for qualiied medical expenses such as deductibles, dental, and vision care. For a

complete list of qualiied medical expenses, visit www.irs.gov in IRS Publication 502.

HSA Benefits Contributing to Your HSA

z Funds always belong to you The IRS limits the amount you can contribute to your

z Funds always roll over from year-to-year HSA each year. At age 55+ you can contribute an

z Lowers your taxable income additional $1,000 catch-up contribution per year.

HSA Triple Tax Savings Coverage Tier IRS Annual Contribution Maximum

2022

Annual

z Tax-free contributions Limit from Summit Contribution

z Tax-free earnings through investment Employee $3,650 $250 $3,400

Employee +

z Tax-free withdrawal for qualiied medical Dependent(s) $7,300 $500 $6,800

expenses

Summit BHC will contribute to your HSA if you

You are Eligible to Open an make contributions to your HSA. Contributions

HSA If from Summit BHC will be made each pay period

z You are enrolled in a qualiied High Deductible throughout the plan year.

Health Plan

z You are not covered by your spouse’s health Saving Your HSA Funds

plan, any other health plan, or lexible spending There is no “use it or lose it” rule. Any unused

account money will remain in your HSA for future use.

If you leave the company or retire, you take

z You are not claimed as a dependent on your HSA funds with you.

someone else’s tax return

z You are not enrolled in Medicare, TRICARE, or

TRICARE for Life

z You have not received veterans administration

beneits in the past 3 months (unless your

beneits are for a service-related disability)

View Your Account at WEX or

Download the App

z View your account

z Transfer funds

z Investment at certain balance thresholds

z Reimburse yourself for expenses incurred

10

A Health Savings Account (HSA) is a tax-favored personal savings account which works with your HDHP. HSA

dollars can be used to pay for qualiied medical expenses such as deductibles, dental, and vision care. For a

complete list of qualiied medical expenses, visit www.irs.gov in IRS Publication 502.

HSA Benefits Contributing to Your HSA

z Funds always belong to you The IRS limits the amount you can contribute to your

z Funds always roll over from year-to-year HSA each year. At age 55+ you can contribute an

z Lowers your taxable income additional $1,000 catch-up contribution per year.

HSA Triple Tax Savings Coverage Tier IRS Annual Contribution Maximum

2022

Annual

z Tax-free contributions Limit from Summit Contribution

z Tax-free earnings through investment Employee $3,650 $250 $3,400

Employee +

z Tax-free withdrawal for qualiied medical Dependent(s) $7,300 $500 $6,800

expenses

Summit BHC will contribute to your HSA if you

You are Eligible to Open an make contributions to your HSA. Contributions

HSA If from Summit BHC will be made each pay period

z You are enrolled in a qualiied High Deductible throughout the plan year.

Health Plan

z You are not covered by your spouse’s health Saving Your HSA Funds

plan, any other health plan, or lexible spending There is no “use it or lose it” rule. Any unused

account money will remain in your HSA for future use.

If you leave the company or retire, you take

z You are not claimed as a dependent on your HSA funds with you.

someone else’s tax return

z You are not enrolled in Medicare, TRICARE, or

TRICARE for Life

z You have not received veterans administration

beneits in the past 3 months (unless your

beneits are for a service-related disability)

View Your Account at WEX or

Download the App

z View your account

z Transfer funds

z Investment at certain balance thresholds

z Reimburse yourself for expenses incurred

10