Page 11 - Summit BHC 2022 Benefits Guide Summit Corporate

P. 11

2022

Benefits Guide

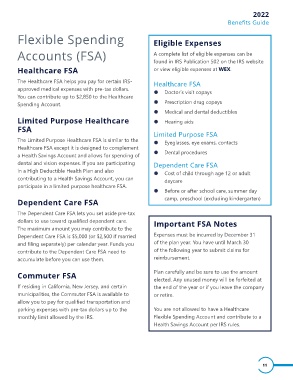

Flexible Spending Eligible Expenses

Accounts (FSA) A complete list of eligible expenses can be

found in IRS Publication 502 on the IRS website

Healthcare FSA or view eligible expenses at WEX.

The Healthcare FSA helps you pay for certain IRS- Healthcare FSA

approved medical expenses with pre-tax dollars. z Doctor’s visit copays

You can contribute up to $2,850 to the Healthcare

Spending Account. z Prescription drug copays

z Medical and dental deductibles

Limited Purpose Healthcare z Hearing aids

FSA

The Limited Purpose Healthcare FSA is similar to the Limited Purpose FSA

z

Eyeglasses, eye exams, contacts

Healthcare FSA except it is designed to complement z

a Health Savings Account and allows for spending of Dental procedures

dental and vision expenses. If you are participating Dependent Care FSA

in a High Deductible Health Plan and also z Cost of child through age 12 or adult

contributing to a Health Savings Account, you can daycare

participate in a limited purpose healthcare FSA.

z Before or after school care, summer day

Dependent Care FSA camp, preschool (excluding kindergarten)

The Dependent Care FSA lets you set aside pre-tax

dollars to use toward qualiied dependent care. Important FSA Notes

The maximum amount you may contribute to the

Dependent Care FSA is $5,000 (or $2,500 if married Expenses must be incurred by December 31

and iling separately) per calendar year. Funds you of the plan year. You have until March 30

contribute to the Dependent Care FSA need to of the following year to submit claims for

accumulate before you can use them. reimbursement.

Commuter FSA Plan carefully and be sure to use the amount

elected. Any unused money will be forfeited at

If residing in California, New Jersey, and certain the end of the year or if you leave the company

municipalities, the Commuter FSA is available to or retire.

allow you to pay for qualiied transportation and

parking expenses with pre-tax dollars up to the You are not allowed to have a Healthcare

monthly limit allowed by the IRS. Flexible Spending Account and contribute to a

Health Savings Account per IRS rules.

11

Benefits Guide

Flexible Spending Eligible Expenses

Accounts (FSA) A complete list of eligible expenses can be

found in IRS Publication 502 on the IRS website

Healthcare FSA or view eligible expenses at WEX.

The Healthcare FSA helps you pay for certain IRS- Healthcare FSA

approved medical expenses with pre-tax dollars. z Doctor’s visit copays

You can contribute up to $2,850 to the Healthcare

Spending Account. z Prescription drug copays

z Medical and dental deductibles

Limited Purpose Healthcare z Hearing aids

FSA

The Limited Purpose Healthcare FSA is similar to the Limited Purpose FSA

z

Eyeglasses, eye exams, contacts

Healthcare FSA except it is designed to complement z

a Health Savings Account and allows for spending of Dental procedures

dental and vision expenses. If you are participating Dependent Care FSA

in a High Deductible Health Plan and also z Cost of child through age 12 or adult

contributing to a Health Savings Account, you can daycare

participate in a limited purpose healthcare FSA.

z Before or after school care, summer day

Dependent Care FSA camp, preschool (excluding kindergarten)

The Dependent Care FSA lets you set aside pre-tax

dollars to use toward qualiied dependent care. Important FSA Notes

The maximum amount you may contribute to the

Dependent Care FSA is $5,000 (or $2,500 if married Expenses must be incurred by December 31

and iling separately) per calendar year. Funds you of the plan year. You have until March 30

contribute to the Dependent Care FSA need to of the following year to submit claims for

accumulate before you can use them. reimbursement.

Commuter FSA Plan carefully and be sure to use the amount

elected. Any unused money will be forfeited at

If residing in California, New Jersey, and certain the end of the year or if you leave the company

municipalities, the Commuter FSA is available to or retire.

allow you to pay for qualiied transportation and

parking expenses with pre-tax dollars up to the You are not allowed to have a Healthcare

monthly limit allowed by the IRS. Flexible Spending Account and contribute to a

Health Savings Account per IRS rules.

11