Page 485 - Most-Essential-Learning-Competencies-Matrix-LATEST-EDITION-FROM-BCD

P. 485

485

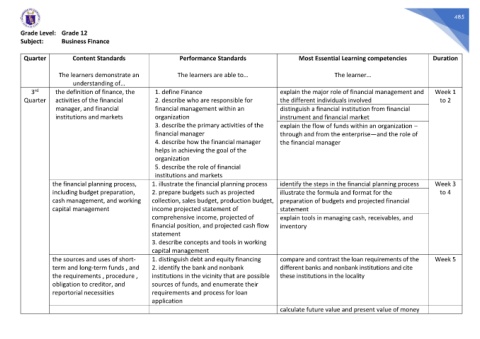

Grade Level: Grade 12

Subject: Business Finance

Quarter Content Standards Performance Standards Most Essential Learning competencies Duration

The learners demonstrate an The learners are able to… The learner…

understanding of…

rd

3 the definition of finance, the 1. define Finance explain the major role of financial management and Week 1

Quarter activities of the financial 2. describe who are responsible for the different individuals involved to 2

manager, and financial financial management within an distinguish a financial institution from financial

institutions and markets organization instrument and financial market

3. describe the primary activities of the explain the flow of funds within an organization –

financial manager through and from the enterprise—and the role of

4. describe how the financial manager the financial manager

helps in achieving the goal of the

organization

5. describe the role of financial

institutions and markets

the financial planning process, 1. illustrate the financial planning process identify the steps in the financial planning process Week 3

including budget preparation, 2. prepare budgets such as projected illustrate the formula and format for the to 4

cash management, and working collection, sales budget, production budget, preparation of budgets and projected financial

capital management income projected statement of statement

comprehensive income, projected of explain tools in managing cash, receivables, and

financial position, and projected cash flow inventory

statement

3. describe concepts and tools in working

capital management

the sources and uses of short- 1. distinguish debt and equity financing compare and contrast the loan requirements of the Week 5

term and long-term funds , and 2. identify the bank and nonbank different banks and nonbank institutions and cite

the requirements , procedure , institutions in the vicinity that are possible these institutions in the locality

obligation to creditor, and sources of funds, and enumerate their

reportorial necessities requirements and process for loan

application

calculate future value and present value of money