Page 486 - Most-Essential-Learning-Competencies-Matrix-LATEST-EDITION-FROM-BCD

P. 486

486

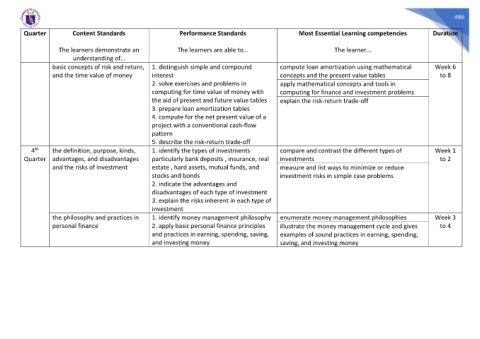

Quarter Content Standards Performance Standards Most Essential Learning competencies Duration

The learners demonstrate an The learners are able to… The learner…

understanding of…

basic concepts of risk and return, 1. distinguish simple and compound compute loan amortization using mathematical Week 6

and the time value of money interest concepts and the present value tables to 8

2. solve exercises and problems in apply mathematical concepts and tools in

computing for time value of money with computing for finance and investment problems

the aid of present and future value tables explain the risk-return trade-off

3. prepare loan amortization tables

4. compute for the net present value of a

project with a conventional cash-flow

pattern

5. describe the risk-return trade-off

th

4 the definition, purpose, kinds, 1. identify the types of investments compare and contrast the different types of Week 1

Quarter advantages, and disadvantages particularly bank deposits , insurance, real investments to 2

and the risks of investment estate , hard assets, mutual funds, and measure and list ways to minimize or reduce

stocks and bonds investment risks in simple case problems

2. indicate the advantages and

disadvantages of each type of investment

3. explain the risks inherent in each type of

investment

the philosophy and practices in 1. identify money management philosophy enumerate money management philosophies Week 3

personal finance 2. apply basic personal finance principles illustrate the money management cycle and gives to 4

and practices in earning, spending, saving, examples of sound practices in earning, spending,

and investing money saving, and investing money