Page 11 - 2022 Clarins Benefit Guide

P. 11

YOUR BENEFITS GUIDE 2022

Health Savings Account

A Health Savings Account (HSA) is a pre-tax benefit account that works like a combination of

an FSA and a 401(k). If you are eligible for the HSA, you may:

• Contribute on a pretax basis

• Pay for everyday healthcare expenses throughout the year

• Save for future healthcare expenses

If you elect the HSA medical plan in 2022, Clarins will also make quarterly contributions to

your account (totaling up to $500 for single coverage and $1,000 for family coverage over the

course of the year).

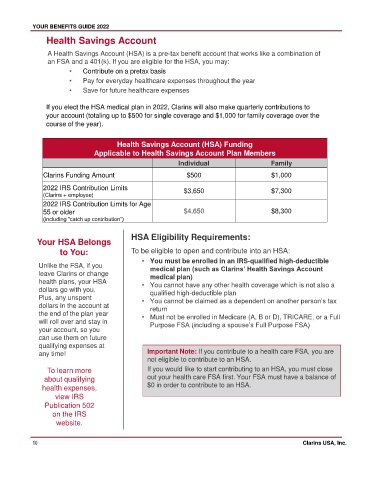

Health Savings Account (HSA) Funding

Applicable to Health Savings Account Plan Members

Individual Family

Clarins Funding Amount $500 $1,000

2022 IRS Contribution Limits $3,650 $7,300

(Clarins + employee)

2022 IRS Contribution Limits for Age

55 or older $4,650 $8,300

(including "catch up contribution“)

HSA Eligibility Requirements:

Your HSA Belongs

to You: To be eligible to open and contribute into an HSA:

• You must be enrolled in an IRS-qualified high-deductible

Unlike the FSA, if you medical plan (such as Clarins’ Health Savings Account

leave Clarins or change medical plan)

health plans, your HSA • You cannot have any other health coverage which is not also a

dollars go with you. qualified high-deductible plan

Plus, any unspent • You cannot be claimed as a dependent on another person’s tax

dollars in the account at return

the end of the plan year • Must not be enrolled in Medicare (A, B or D), TRICARE, or a Full

will roll over and stay in Purpose FSA (including a spouse’s Full Purpose FSA)

your account, so you

can use them on future

qualifying expenses at

any time! Important Note: If you contribute to a health care FSA, you are

not eligible to contribute to an HSA.

To learn more If you would like to start contributing to an HSA, you must close

about qualifying out your health care FSA first. Your FSA must have a balance of

health expenses, $0 in order to contribute to an HSA.

view IRS

Publication 502

on the IRS

website.

10 Clarins USA, Inc.