Page 12 - 2022 Clarins Benefit Guide

P. 12

YOUR BENEFITS GUIDE 2022

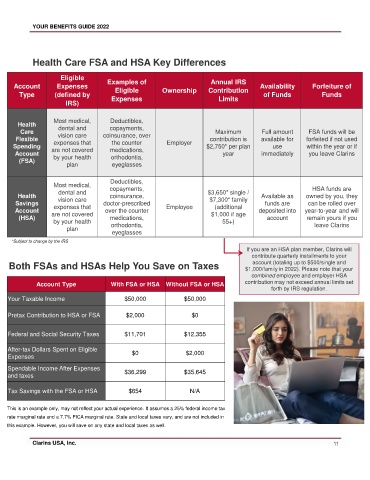

Health Care FSA and HSA Key Differences

Eligible

Annual IRS

Account Expenses Examples of Ownership Contribution Availability Forfeiture of

Eligible

Type (defined by Expenses Limits of Funds Funds

IRS)

Most medical, Deductibles,

Health dental and copayments,

Care Maximum Full amount FSA funds will be

Flexible vision care coinsurance, over contribution is available for forfeited if not used

expenses that

the counter

Spending are not covered medications, Employer $2,750* per plan use within the year or if

Account by your health orthodontia, year immediately you leave Clarins

(FSA)

plan eyeglasses

Deductibles,

Most medical, copayments, HSA funds are

dental and $3,650* single /

Health coinsurance, Available as owned by you, they

Savings vision care doctor-prescribed $7,300* family funds are can be rolled over

(additional

expenses that

Account are not covered over the counter Employee $1,000 if age deposited into year-to-year and will

(HSA) medications, account remain yours if you

by your health orthodontia, 55+) leave Clarins

plan

eyeglasses

*Subject to change by the IRS

If you are an HSA plan member, Clarins will

contribute quarterly installments to your

account (totaling up to $500/single and

Both FSAs and HSAs Help You Save on Taxes $1,000/family in 2022). Please note that your

combined employee and employer HSA

Account Type With FSA or HSA Without FSA or HSA contribution may not exceed annual limits set

forth by IRS regulation.

Your Taxable Income $50,000 $50,000

Pretax Contribution to HSA or FSA $2,000 $0

Federal and Social Security Taxes $11,701 $12,355

After-tax Dollars Spent on Eligible $0 $2,000

Expenses

Spendable Income After Expenses $36,299 $35,645

and taxes

Tax Savings with the FSA or HSA $654 N/A

This is an example only, may not reflect your actual experience. It assumes a 25% federal income tax

rate marginal rate and a 7.7% FICA marginal rate. State and local taxes vary, and are not included in

this example. However, you will save on any state and local taxes as well.

Clarins USA, Inc. 11