Page 8 - 1800Flowers 2022 Benefits Guide

P. 8

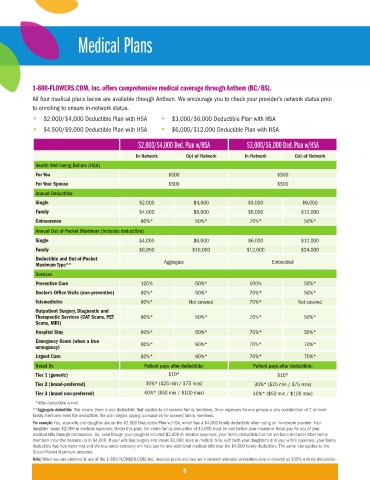

Medical Plans

1-800-FLOWERS.COM, Inc. offers comprehensive medical coverage through Anthem (BC/BS).

All four medical plans below are available through Anthem. We encourage you to check your provider’s network status prior

to enrolling to ensure in-network status.

• $2,000/$4,000 Deductible Plan with HSA • $3,000/$6,000 Deductible Plan with HSA

• $4,500/$9,000 Deductible Plan with HSA • $6,000/$12,000 Deductible Plan with HSA

$2,000/$4,000 Ded. Plan w/HSA $3,000/$6,000 Ded. Plan w/HSA

In-Network Out-of-Network In-Network Out-of-Network

Health Well-being Dollars (HSA)

For You $500 $500

For Your Spouse $500 $500

Annual Deductible

Single $2,000 $4,000 $3,000 $6,000

Family $4,000 $8,000 $6,000 $12,000

Coinsurance 80%* 50%* 70%* 50%*

Annual Out-of-Pocket Maximum (includes deductible)

Single $4,000 $8,000 $6,000 $12,000

Family $6,850 $16,000 $12,000 $24,000

Deductible and Out-of-Pocket Aggregate Embedded

Maximum Type**

Services

Preventive Care 100% 50%* 100% 50%*

Doctor’s Office Visits (non-preventive) 80%* 50%* 70%* 50%*

Telemedicine 80%* Not covered 70%* Not covered

Outpatient Surgery, Diagnostic and

Therapeutic Services (CAT Scans, PET 80%* 50%* 70%* 50%*

Scans, MRI)

Hospital Stay 80%* 50%* 70%* 50%*

Emergency Room (when a true 80%* 80%* 70%* 70%*

emergency)

Urgent Care 80%* 80%* 70%* 70%*

Retail Rx Patient pays after deductible: Patient pays after deductible:

Tier 1 (generic) $10* $10*

Tier 2 (brand-preferred) 30%* ($25 min / $75 max) 30%* ($25 min / $75 max)

Tier 3 (brand non-preferred) 40%* ($50 min / $100 max) 40%* ($50 min / $100 max)

*After deductible is met.

**Aggregate deductible: This means there is one deductible that applies to all covered family members. Once expenses for one person or any combination of 2 or more

family members meet the deductible, the plan begins paying coinsurance for covered family members.

For example: You, your wife and daughter are on the $2,000 Deductible Plan w/HSA, which has a $4,000 family deductible when using an in-network provider. Your

daughter incurs $2,000 in medical expenses. Under this plan, the entire family deductible of $4,000 must be met before your insurance helps pay for any of your

medical bills through coinsurance. So, even though your daughter incurred $2,000 in medical expenses, your family deductible has not yet been met until other family

members incur the balance up to $4,000. If your wife has surgery and incurs $2,000 more in medical bills, with both your daughter’s and your wife’s expenses, your family

deductible has now been met and the insurance company will help pay for any additional medical bills over the $4,000 family deductible. The same rule applies to the

Out-of-Pocket Maximum amounts.

Note: When you are enrolled in any of the 1-800-FLOWERS.COM, Inc. medical plans and see an in-network provider, preventive care is covered at 100% with no deductible.

8