Page 12 - TriStar Energy-2023-Benefit Guide-V26(WLP)-LRI

P. 12

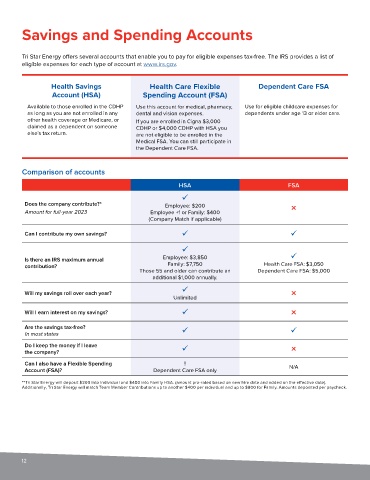

Savings and Spending Accounts

Tri Star Energy offers several accounts that enable you to pay for eligible expenses tax-free. The IRS provides a list of

eligible expenses for each type of account at www.irs.gov.

Health Savings Health Care Flexible Dependent Care FSA

Account (HSA) Spending Account (FSA)

Available to those enrolled in the CDHP Use this account for medical, pharmacy, Use for eligible childcare expenses for

as long as you are not enrolled in any dental and vision expenses. dependents under age 13 or elder care.

other health coverage or Medicare, or If you are enrolled in Cigna $3,000

claimed as a dependent on someone CDHP or $4,000 CDHP with HSA you

else’s tax return. are not eligible to be enrolled in the

Medical FSA. You can still participate in

the Dependent Care FSA.

Comparison of accounts

HSA FSA

Does the company contribute?* Employee: $200 X

Amount for full-year 2023 Employee +1 or Family: $400

(Company Match if applicable)

Can I contribute my own savings?

Is there an IRS maximum annual Employee: $3,850

contribution? Family: $7,750 Health Care FSA: $3,050

Those 55 and older can contribute an Dependent Care FSA: $5,000

additional $1,000 annually.

Will my savings roll over each year? X

Unlimited

Will I earn interest on my savings? X

Are the savings tax-free?

In most states

Do I keep the money if I leave X

the company?

Can I also have a Flexible Spending ! N/A

Account (FSA)? Dependent Care FSA only

**Tri Star Energy will deposit $200 into Individual and $400 into Family HSA. (amount pro-rated based on new hire date and added on the effective date).

Additionally, Tri Star Energy will match Team Member Contributions up to another $400 per individual and up to $800 for Family. Amounts deposited per paycheck.

12