Page 8 - Skyworks Solutions, Inc.

P. 8

Health

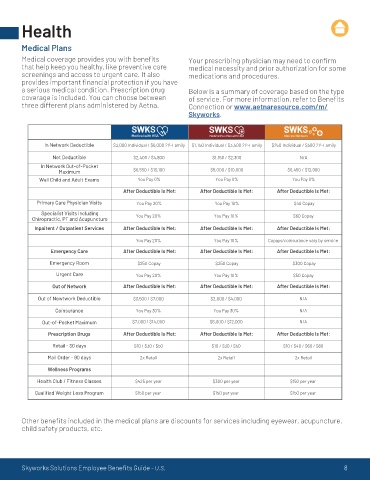

Medical Plans

Medical coverage provides you with benefits Your prescribing physician may need to confirm

that help keep you healthy, like preventive care medical necessity and prior authorization for some

screenings and access to urgent care. It also medications and procedures.

provides important financial protection if you have

a serious medical condition. Prescription drug Below is a summary of coverage based on the type

coverage is included. You can choose between of service. For more information, refer to Benefits

three different plans administered by Aetna. Connection or www.aetnaresource.com/m/

Skyworks.

In Network Deductible $3,000 Individual / $6,000 2P-Family $1,750 Individual / $3,500 2P-Family $250 Individual / $500 2P-Family

Net Deductible $2,400 / $4,800 $1,150 / $2,300 N/A

In Network Out-of-Pocket

Maximum $6,550 / $13,100 $5,000 / $10,000 $6,450 / $12,900

Well Child and Adult Exams You Pay 0% You Pay 0% You Pay 0%

After Deductible Is Met: After Deductible Is Met: After Deductible Is Met:

Primary Care Physician Visits You Pay 20% You Pay 10% $40 Copay

Specialist Visits including You Pay 20% You Pay 10% $60 Copay

Chiropractic, PT and Acupuncture

Inpaitent / Outpatient Services After Deductible Is Met: After Deductible Is Met: After Deductible Is Met:

You Pay 20% You Pay 10% Copays/coinsurance vary by service

Emergency Care After Deductible Is Met: After Deductible Is Met: After Deductible Is Met:

Emergency Room $250 Copay $250 Copay $300 Copay

Urgent Care You Pay 20% You Pay 10% $50 Copay

Out of Network After Deductible Is Met: After Deductible Is Met: After Deductible Is Met:

Out of Newtwork Deductible $3,500 / $7,000 $2,000 / $4,000 N/A

Coinsurance You Pay 30% You Pay 30% N/A

Out-of-Pocket Maximum $7,000 / $14,000 $6,000 / $12,000 N/A

Prescription Drugs After Deductible Is Met: After Deductible Is Met: After Deductible Is Met:

Retail - 30 days $10 / $30 / $50 $10 / $30 / $50 $10 / $40 / $60 / $80

Mail Order - 90 days 2x Retail 2x Retail 2x Retail

Wellness Programs

Health Club / Fitness Classes $425 per year $300 per year $150 per year

Qualified Weight Loss Program $150 per year $150 per year $150 per year

Other benefits included in the medical plans are discounts for services including eyewear, acupuncture,

child safety products, etc.

Skyworks Solutions Employee Benefits Guide - U.S. 8