Page 20 - TCL International VILLETA BUSINESS PLAN AND FEASABILITY STUDY

P. 20

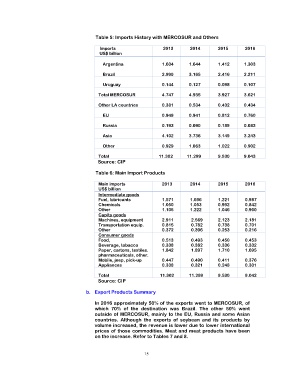

Table 5: Imports History with MERCOSUR and Others

Imports 2013 2014 2015 2016

US$ billion

Argentina 1.604 1.644 1.412 1.303

Brazil 2.999 3.165 2.416 2.211

Uruguay 0.144 0.127 0.098 0.107

Total MERCOSUR 4.747 4.935 3.927 3.621

Other LA countries 0.381 0.534 0.432 0.434

EU 0.949 0.941 0.812 0.760

Russia 0.193 0.090 0.189 0.083

Asia 4.102 3.736 3.149 3.243

Other 0.929 1.063 1.022 0.902

Total 11.302 11.299 9.530 9.043

Source: CIP

Table 6: Main Import Products

Main imports 2013 2014 2015 2016

US$ billion

Intermediate goods

Fuel, lubricants 1.571 1.696 1.221 0.987

Chemicals 1.050 1.053 0.992 0.842

Other 1.105 1.222 1.046 0.960

Capita goods

Machines, equipment 2.911 2.569 2.123 2.181

Transportation equip. 0.815 0.782 0.738 0.701

Other 0.372 0.396 0.253 0.216

Consumer goods

Food, 0.513 0.493 0.450 0.453

Beverage, tobacco 0.338 0.382 0.336 0.332

Paper, cartons, textiles. 1.842 1.897 1.710 1.695

pharmaceuticals, other.

Mobile, jeep, pick-up 0.447 0.490 0.411 0.376

Appliances 0.338 0.321 0.248 0.301

Total 11.302 11.299 9.530 9.042

Source: CIP

b. Export Products Summary

In 2016 approximately 50% of the exports went to MERCOSUR, of

which 70% of the destination was Brazil. The other 50% went

outside of MERCOSUR, mainly to the EU, Russia and some Asian

countries. Although the exports of soybean and its products by

volume increased, the revenue is lower due to lower international

prices of those commodities. Meat and meat products have been

on the increase. Refer to Tables 7 and 8.

15