Page 166 - NobleCon21

P. 166

Energy

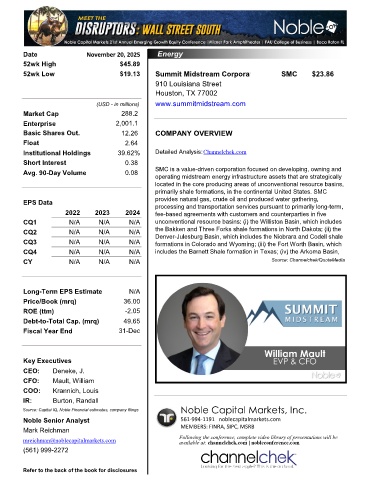

Date November 20, 2025 Energy

52wk High $45.89

52wk Low $19.13 Summit Midstream Corporat SMC $23.86

910 Louisiana Street

Houston, TX 77002

(USD - in millions) www.summitmidstream.com

Market Cap 288.2

Enterprise 2,001.1

Basic Shares Out. 12.26 COMPANY OVERVIEW

Float 2.64

Institutional Holdings 39.62% Detailed Analysis:Channelchek.com

Short Interest 0.38

Avg. 90-Day Volume 0.08 SMC is a value-driven corporation focused on developing, owning and

operating midstream energy infrastructure assets that are strategically

located in the core producing areas of unconventional resource basins,

primarily shale formations, in the continental United States. SMC

EPS Data provides natural gas, crude oil and produced water gathering,

processing and transportation services pursuant to primarily long-term,

2022 2023 2024 fee-based agreements with customers and counterparties in five

CQ1 N/A N/A N/A unconventional resource basins: (i) the Williston Basin, which includes

CQ2 N/A N/A N/A the Bakken and Three Forks shale formations in North Dakota; (ii) the

Denver-Julesburg Basin, which includes the Niobrara and Codell shale

CQ3 N/A N/A N/A formations in Colorado and Wyoming; (iii) the Fort Worth Basin, which

CQ4 N/A N/A N/A includes the Barnett Shale formation in Texas; (iv) the Arkoma Basin,

f

CY N/A N/A N/A f C Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 36.00

ROE (ttm) -2.05

Debt-to-Total Cap. (mrq) 49.65

Fiscal Year End 31-Dec

910 Louisiana Houston TX 77002

Key Executives

CEO: Deneke, J.

CFO: Mault, William

COO: Krannich, Louis

IR: Burton, Randall

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Mark Reichman MEMBERS: FINRA, SIPC, MSRB

mreichman@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2272

Refer to the back of the book for disclosures