Page 168 - NobleCon21

P. 168

Consumer

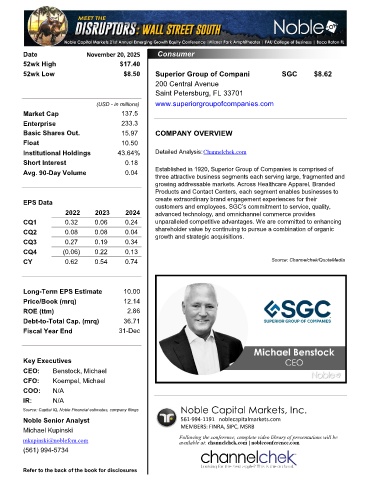

Date November 20, 2025 Consumer Discretionary

52wk High $17.40

52wk Low $8.50 Superior Group of Companie SGC $8.62

200 Central Avenue

Saint Petersburg, FL 33701

(USD - in millions) www.superiorgroupofcompanies.com

Market Cap 137.5

Enterprise 233.3

Basic Shares Out. 15.97 COMPANY OVERVIEW

Float 10.50

Institutional Holdings 43.64% Detailed Analysis:Channelchek.com

Short Interest 0.18

Avg. 90-Day Volume 0.04 Established in 1920, Superior Group of Companies is comprised of

three attractive business segments each serving large, fragmented and

growing addressable markets. Across Healthcare Apparel, Branded

Products and Contact Centers, each segment enables businesses to

EPS Data create extraordinary brand engagement experiences for their

customers and employees. SGC’s commitment to service, quality,

2022 2023 2024 advanced technology, and omnichannel commerce provides

CQ1 0.32 0.06 0.24 unparalleled competitive advantages. We are committed to enhancing

CQ2 0.08 0.08 0.04 shareholder value by continuing to pursue a combination of organic

growth and strategic acquisitions.

CQ3 0.27 0.19 0.34

CQ4 (0.06) 0.22 0.13

CY 0.62 0.54 0.74 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate 10.00

Price/Book (mrq) 12.14

ROE (ttm) 2.86

Debt-to-Total Cap. (mrq) 36.71

Fiscal Year End 31-Dec

200 Central AvSaint PetersbuFL 33701

Key Executives

CEO: Benstock, Michael

CFO: Koempel, Michael

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Michael Kupinski MEMBERS: FINRA, SIPC, MSRB

mkupinski@noblefcm.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 994-5734

Refer to the back of the book for disclosures