Page 114 - Internal Auditing Standards

P. 114

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Designing and Performing Further Audit Procedures

The nature, timing, and extent of further audit procedures are based on, and are responsive to, the assessed

risks of material misstatement at the assertion level. This provides a clear linkage between the auditor’s

further audit procedures and the risk assessment.

The first step is to review the information obtained to date that will form the basis for the design of further

audit procedures. This would include:

• The nature and the reasoning for the assessed risks (such as business and fraud risks) at both the

financial- statement and assertion levels;

• The account balances, classes of transactions, or disclosures that are material to the fi nancial statements;

• The need (if any) to perform tests of controls. This would occur where substantive procedures alone

cannot provide sufficient appropriate audit evidence at the assertion level;

• The auditor’s understanding of the control environment and control activities. In particular, have any

relevant internal controls been identified that, if tested, would provide an effective response to the

assessed risks of material misstatement for a particular assertion; and

• The nature and extent of specific audit procedures that may be required by certain ISAs, or by local rules

and regulations.

Based on the information above, the auditor can design the nature and extent of the procedures to be

performed. Some design considerations are addressed below.

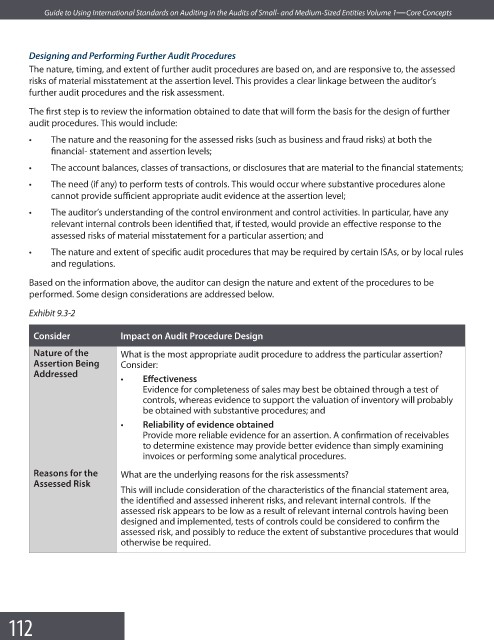

Exhibit 9.3-2

Consider Impact on Audit Procedure Design

Nature of the What is the most appropriate audit procedure to address the particular assertion?

Assertion Being Consider:

Addressed

• Eff ectiveness

Evidence for completeness of sales may best be obtained through a test of

controls, whereas evidence to support the valuation of inventory will probably

be obtained with substantive procedures; and

• Reliability of evidence obtained

Provide more reliable evidence for an assertion. A confirmation of receivables

to determine existence may provide better evidence than simply examining

invoices or performing some analytical procedures.

Reasons for the What are the underlying reasons for the risk assessments?

Assessed Risk

This will include consideration of the characteristics of the financial statement area,

the identified and assessed inherent risks, and relevant internal controls. If the

assessed risk appears to be low as a result of relevant internal controls having been

designed and implemented, tests of controls could be considered to confi rm the

assessed risk, and possibly to reduce the extent of substantive procedures that would

otherwise be required.

112