Page 116 - Internal Auditing Standards

P. 116

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

In some situations, there can be some advantages to performing audit procedures before the period end. For

example:

• Helping to identify significant matters at an early stage. This provides time for the issues to be addressed

and further audit procedures to be performed;

• Balancing the audit firm’s workload by shifting some busy-season procedures to a period when there is

more time;

• Balancing the client’s workload by reducing the time required after the period end to answer audit

inquiries and provide requested evidence and schedules; and

• Performing procedures unannounced or at unpredictable times.

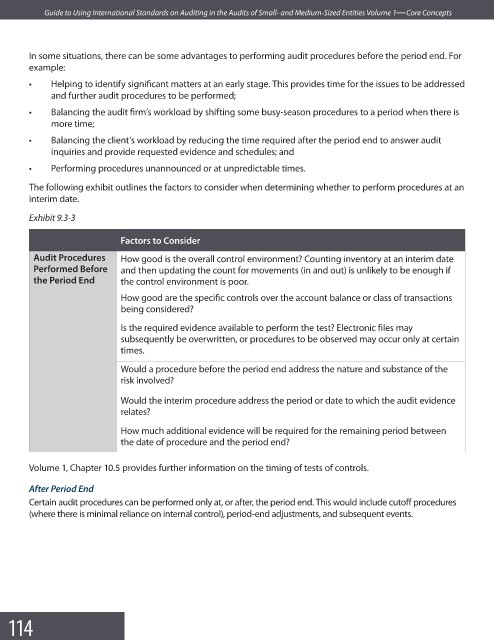

The following exhibit outlines the factors to consider when determining whether to perform procedures at an

interim date.

Exhibit 9.3-3

Factors to Consider

Audit Procedures How good is the overall control environment? Counting inventory at an interim date

Performed Before and then updating the count for movements (in and out) is unlikely to be enough if

the Period End the control environment is poor.

How good are the specific controls over the account balance or class of transactions

being considered?

Is the required evidence available to perform the test? Electronic fi les may

subsequently be overwritten, or procedures to be observed may occur only at certain

times.

Would a procedure before the period end address the nature and substance of the

risk involved?

Would the interim procedure address the period or date to which the audit evidence

relates?

How much additional evidence will be required for the remaining period between

the date of procedure and the period end?

Volume 1, Chapter 10.5 provides further information on the timing of tests of controls.

After Period End

Certain audit procedures can be performed only at, or after, the period end. This would include cutoff procedures

(where there is minimal reliance on internal control), period-end adjustments, and subsequent events.

114