Page 121 - Internal Auditing Standards

P. 121

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Performing Substantive Procedures at an Interim Date

When substantive procedures are performed at an interim date, the auditor should perform further

substantive procedures, or substantive procedures combined with tests of controls, to cover the remaining

period. This provides a reasonable basis for extending the audit conclusions from the interim date to the

period end, and reduces the risk that misstatements existing at the period end are not detected. However, if

substantive procedures alone would not be sufficient, tests of the relevant controls should also be performed.

Procedures to Address the Period between the Interim Date and Period End

When procedures are performed at an interim date:

• Compare information at the period end with comparable information at the interim date;

• Identify amounts that appear unusual. These amounts should be investigated by performing further

substantive analytical procedures or tests of details for the intervening period;

• When substantive analytical procedures are planned, consider whether the period-end balances of

the particular classes of transactions or account balances are reasonably predictable with respect to

amount, relative significance, and composition; and

• Consider the entity’s procedures for analyzing and adjusting the classes of transactions or account

balances at interim dates, and for establishing proper accounting cutoff s.

The substantive procedures related to the remaining period depend on whether the auditor has performed

tests of controls.

Use of Substantive Procedures Performed in Prior Periods

The use of audit evidence obtained from substantive procedures performed in prior periods may be useful

in audit planning, but (unless there is ongoing relevance to the current year such as the cost price of non-

current assets or details of contracts) it usually provides little or no audit evidence for the current period.

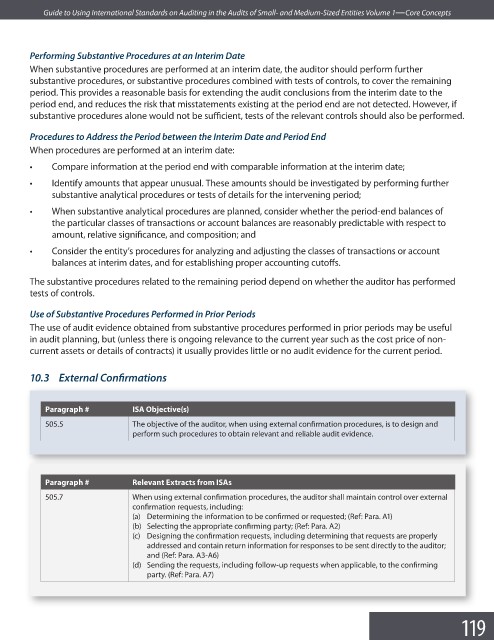

10.3 External Confi rmations

Paragraph # ISA Objective(s)

505.5 The objective of the auditor, when using external confirmation procedures, is to design and

perform such procedures to obtain relevant and reliable audit evidence.

Paragraph # Relevant Extracts from ISAs

505.7 When using external confirmation procedures, the auditor shall maintain control over external

confirmation requests, including:

(a) Determining the information to be confirmed or requested; (Ref: Para. A1)

(b) Selecting the appropriate confirming party; (Ref: Para. A2)

(c) Designing the confirmation requests, including determining that requests are properly

addressed and contain return information for responses to be sent directly to the auditor;

and (Ref: Para. A3-A6)

(d) Sending the requests, including follow-up requests when applicable, to the confi rming

party. (Ref: Para. A7)

119