Page 123 - Internal Auditing Standards

P. 123

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

External confirmations are often used to provide audit evidence about completeness of a liability and

existence of an asset. External confirmation can also provides evidence on whether the amount has been

accurately recorded in the accounting records (accuracy) and in the appropriate period (cutoff ). Confi rmations

are less relevant in addressing valuation issues such as the recoverability of accounts receivable or the

obsolescence of inventory being held.

Typical situations where external confirmation procedures provide relevant audit evidence include:

• Bank balances and other information relevant to banking relationships;

• Accounts receivable balances and terms;

• Inventories held by third parties at bonded warehouses for processing or on consignment;

• Property title deeds held by lawyers or financiers for safe custody or as security;

• Investments held for safekeeping by third parties, or purchased from stockbrokers but not delivered at

the balance-sheet date;

• Amounts due to lenders, including relevant terms of repayment and restrictive covenants; and

• Accounts payable balances and terms.

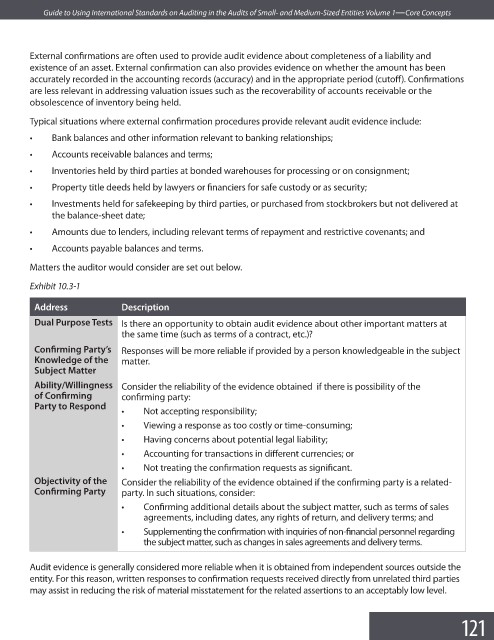

Matters the auditor would consider are set out below.

Exhibit 10.3-1

Address Description

Dual Purpose Tests Is there an opportunity to obtain audit evidence about other important matters at

the same time (such as terms of a contract, etc.)?

Confi rming Party’s Responses will be more reliable if provided by a person knowledgeable in the subject

Knowledge of the matter.

Subject Matter

Ability/Willingness Consider the reliability of the evidence obtained if there is possibility of the

of Confi rming confi rming party:

Party to Respond

• Not accepting responsibility;

• Viewing a response as too costly or time-consuming;

• Having concerns about potential legal liability;

• Accounting for transactions in different currencies; or

• Not treating the confirmation requests as signifi cant.

Objectivity of the Consider the reliability of the evidence obtained if the confirming party is a related-

Confi rming Party party. In such situations, consider:

• Confirming additional details about the subject matter, such as terms of sales

agreements, including dates, any rights of return, and delivery terms; and

• Supplementing the confirmation with inquiries of non-financial personnel regarding

the subject matter, such as changes in sales agreements and delivery terms.

Audit evidence is generally considered more reliable when it is obtained from independent sources outside the

entity. For this reason, written responses to confirmation requests received directly from unrelated third parties

may assist in reducing the risk of material misstatement for the related assertions to an acceptably low level.

121