Page 128 - Internal Auditing Standards

P. 128

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

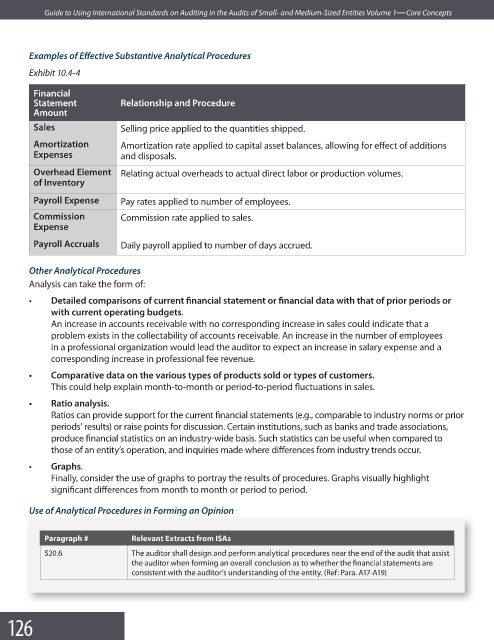

Examples of Effective Substantive Analytical Procedures

Exhibit 10.4-4

Financial

Statement Relationship and Procedure

Amount

Sales Selling price applied to the quantities shipped.

Amortization Amortization rate applied to capital asset balances, allowing for effect of additions

Expenses and disposals.

Overhead Element Relating actual overheads to actual direct labor or production volumes.

of Inventory

Payroll Expense Pay rates applied to number of employees.

Commission Commission rate applied to sales.

Expense

Payroll Accruals Daily payroll applied to number of days accrued.

Other Analytical Procedures

Analysis can take the form of:

• Detailed comparisons of current financial statement or financial data with that of prior periods or

with current operating budgets.

An increase in accounts receivable with no corresponding increase in sales could indicate that a

problem exists in the collectability of accounts receivable. An increase in the number of employees

in a professional organization would lead the auditor to expect an increase in salary expense and a

corresponding increase in professional fee revenue.

• Comparative data on the various types of products sold or types of customers.

This could help explain month-to-month or period-to-period fluctuations in sales.

• Ratio analysis.

Ratios can provide support for the current financial statements (e.g., comparable to industry norms or prior

periods’ results) or raise points for discussion. Certain institutions, such as banks and trade associations,

produce financial statistics on an industry-wide basis. Such statistics can be useful when compared to

those of an entity’s operation, and inquiries made where differences from industry trends occur.

• Graphs.

Finally, consider the use of graphs to portray the results of procedures. Graphs visually highlight

signifi cant differences from month to month or period to period.

p

g

y

Use of Analytical Procedures in Forming an Opinion

Paragraph # Relevant Extracts from ISAs

520.6 The auditor shall design and perform analytical procedures near the end of the audit that assist

the auditor when forming an overall conclusion as to whether the financial statements are

consistent with the auditor’s understanding of the entity. (Ref: Para. A17-A19)

126