Page 127 - Internal Auditing Standards

P. 127

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

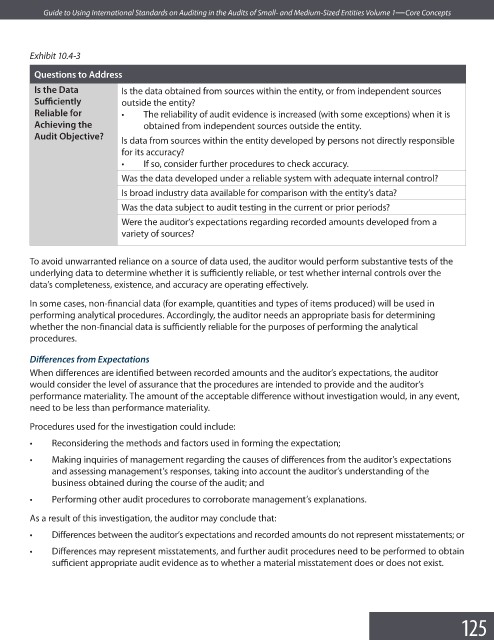

Exhibit 10.4-3

Questions to Address

Is the Data Is the data obtained from sources within the entity, or from independent sources

Suffi ciently outside the entity?

Reliable for • The reliability of audit evidence is increased (with some exceptions) when it is

Achieving the obtained from independent sources outside the entity.

Audit Objective?

Is data from sources within the entity developed by persons not directly responsible

for its accuracy?

• If so, consider further procedures to check accuracy.

Was the data developed under a reliable system with adequate internal control?

Is broad industry data available for comparison with the entity’s data?

Was the data subject to audit testing in the current or prior periods?

Were the auditor’s expectations regarding recorded amounts developed from a

variety of sources?

To avoid unwarranted reliance on a source of data used, the auditor would perform substantive tests of the

underlying data to determine whether it is sufficiently reliable, or test whether internal controls over the

data’s completeness, existence, and accuracy are operating eff ectively.

In some cases, non-financial data (for example, quantities and types of items produced) will be used in

performing analytical procedures. Accordingly, the auditor needs an appropriate basis for determining

whether the non-financial data is sufficiently reliable for the purposes of performing the analytical

procedures.

Differences from Expectations

When differences are identified between recorded amounts and the auditor’s expectations, the auditor

would consider the level of assurance that the procedures are intended to provide and the auditor’s

performance materiality. The amount of the acceptable difference without investigation would, in any event,

need to be less than performance materiality.

Procedures used for the investigation could include:

• Reconsidering the methods and factors used in forming the expectation;

• Making inquiries of management regarding the causes of differences from the auditor’s expectations

and assessing management’s responses, taking into account the auditor’s understanding of the

business obtained during the course of the audit; and

• Performing other audit procedures to corroborate management’s explanations.

As a result of this investigation, the auditor may conclude that:

• Differences between the auditor’s expectations and recorded amounts do not represent misstatements; or

• Differences may represent misstatements, and further audit procedures need to be performed to obtain

sufficient appropriate audit evidence as to whether a material misstatement does or does not exist.

125