Page 124 - Internal Auditing Standards

P. 124

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

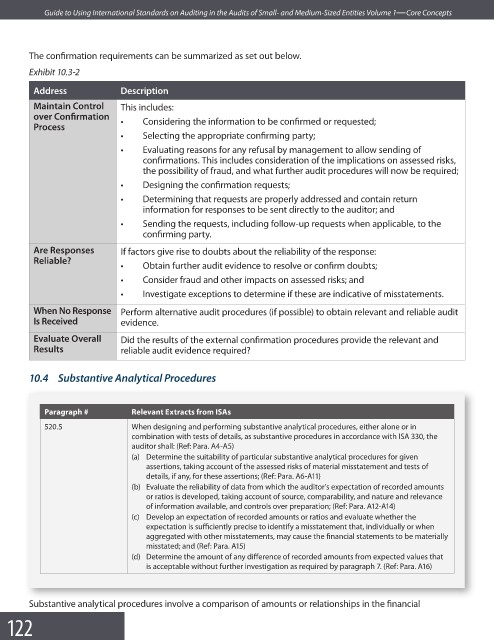

The confirmation requirements can be summarized as set out below.

Exhibit 10.3-2

Address Description

Maintain Control This includes:

over Confi rmation • Considering the information to be confirmed or requested;

Process

• Selecting the appropriate confi rming party;

• Evaluating reasons for any refusal by management to allow sending of

confirmations. This includes consideration of the implications on assessed risks,

the possibility of fraud, and what further audit procedures will now be required;

• Designing the confi rmation requests;

• Determining that requests are properly addressed and contain return

information for responses to be sent directly to the auditor; and

• Sending the requests, including follow-up requests when applicable, to the

confi rming party.

Are Responses If factors give rise to doubts about the reliability of the response:

Reliable?

• Obtain further audit evidence to resolve or confi rm doubts;

• Consider fraud and other impacts on assessed risks; and

• Investigate exceptions to determine if these are indicative of misstatements.

When No Response Perform alternative audit procedures (if possible) to obtain relevant and reliable audit

Is Received evidence.

Evaluate Overall Did the results of the external confirmation procedures provide the relevant and

Results reliable audit evidence required?

10.4 Substantive Analytical Procedures

Paragraph # Relevant Extracts from ISAs

520.5 When designing and performing substantive analytical procedures, either alone or in

combination with tests of details, as substantive procedures in accordance with ISA 330, the

auditor shall: (Ref: Para. A4-A5)

(a) Determine the suitability of particular substantive analytical procedures for given

assertions, taking account of the assessed risks of material misstatement and tests of

details, if any, for these assertions; (Ref: Para. A6-A11)

(b) Evaluate the reliability of data from which the auditor’s expectation of recorded amounts

or ratios is developed, taking account of source, comparability, and nature and relevance

of information available, and controls over preparation; (Ref: Para. A12-A14)

(c) Develop an expectation of recorded amounts or ratios and evaluate whether the

expectation is sufficiently precise to identify a misstatement that, individually or when

aggregated with other misstatements, may cause the financial statements to be materially

misstated; and (Ref: Para. A15)

(d) Determine the amount of any difference of recorded amounts from expected values that

is acceptable without further investigation as required by paragraph 7. (Ref: Para. A16)

Substantive analytical procedures involve a comparison of amounts or relationships in the fi nancial

122