Page 109 - Internal Auditing Standards

P. 109

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

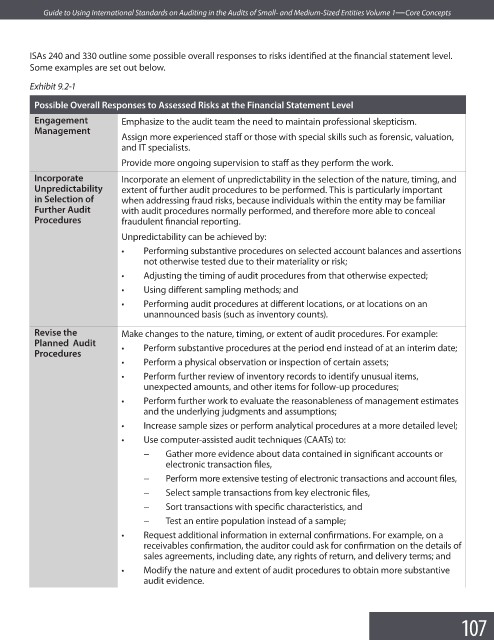

ISAs 240 and 330 outline some possible overall responses to risks identified at the financial statement level.

Some examples are set out below.

Exhibit 9.2-1

Possible Overall Responses to Assessed Risks at the Financial Statement Level

Engagement Emphasize to the audit team the need to maintain professional skepticism.

Management

Assign more experienced staff or those with special skills such as forensic, valuation,

and IT specialists.

Provide more ongoing supervision to staff as they perform the work.

Incorporate Incorporate an element of unpredictability in the selection of the nature, timing, and

Unpredictability extent of further audit procedures to be performed. This is particularly important

in Selection of when addressing fraud risks, because individuals within the entity may be familiar

Further Audit with audit procedures normally performed, and therefore more able to conceal

Procedures fraudulent fi nancial reporting.

Unpredictability can be achieved by:

• Performing substantive procedures on selected account balances and assertions

not otherwise tested due to their materiality or risk;

• Adjusting the timing of audit procedures from that otherwise expected;

• Using different sampling methods; and

• Performing audit procedures at different locations, or at locations on an

unannounced basis (such as inventory counts).

Revise the Make changes to the nature, timing, or extent of audit procedures. For example:

Planned Audit • Perform substantive procedures at the period end instead of at an interim date;

Procedures

• Perform a physical observation or inspection of certain assets;

• Perform further review of inventory records to identify unusual items,

unexpected amounts, and other items for follow-up procedures;

• Perform further work to evaluate the reasonableness of management estimates

and the underlying judgments and assumptions;

• Increase sample sizes or perform analytical procedures at a more detailed level;

• Use computer-assisted audit techniques (CAATs) to:

− Gather more evidence about data contained in significant accounts or

electronic transaction fi les,

− Perform more extensive testing of electronic transactions and account fi les,

− Select sample transactions from key electronic fi les,

− Sort transactions with specific characteristics, and

− Test an entire population instead of a sample;

• Request additional information in external confirmations. For example, on a

receivables confirmation, the auditor could ask for confirmation on the details of

sales agreements, including date, any rights of return, and delivery terms; and

• Modify the nature and extent of audit procedures to obtain more substantive

audit evidence.

107