Page 54 - Internal Auditing Standards

P. 54

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

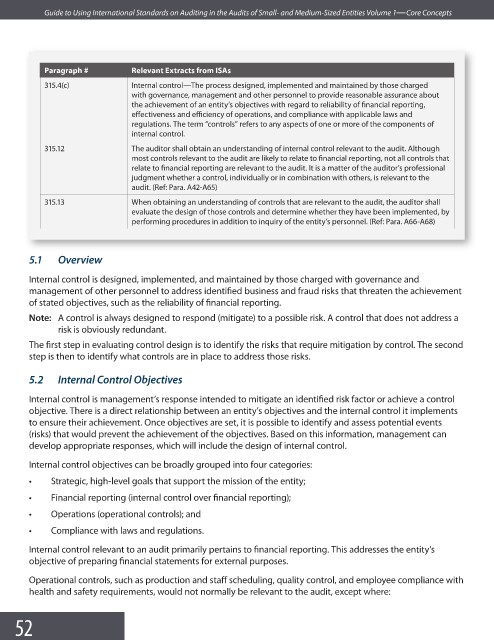

Paragraph # Relevant Extracts from ISAs

315.4(c) Internal control—The process designed, implemented and maintained by those charged

with governance, management and other personnel to provide reasonable assurance about

the achievement of an entity’s objectives with regard to reliability of fi nancial reporting,

effectiveness and efficiency of operations, and compliance with applicable laws and

regulations. The term “controls” refers to any aspects of one or more of the components of

internal control.

315.12 The auditor shall obtain an understanding of internal control relevant to the audit. Although

most controls relevant to the audit are likely to relate to financial reporting, not all controls that

relate to financial reporting are relevant to the audit. It is a matter of the auditor’s professional

judgment whether a control, individually or in combination with others, is relevant to the

audit. (Ref: Para. A42-A65)

315.13 When obtaining an understanding of controls that are relevant to the audit, the auditor shall

evaluate the design of those controls and determine whether they have been implemented, by

performing procedures in addition to inquiry of the entity’s personnel. (Ref: Para. A66-A68)

5.1 Overview

Internal control is designed, implemented, and maintained by those charged with governance and

management of other personnel to address identified business and fraud risks that threaten the achievement

of stated objectives, such as the reliability of fi nancial reporting.

Note: A control is always designed to respond (mitigate) to a possible risk. A control that does not address a

risk is obviously redundant.

The first step in evaluating control design is to identify the risks that require mitigation by control. The second

step is then to identify what controls are in place to address those risks.

5.2 Internal Control Objectives

Internal control is management’s response intended to mitigate an identified risk factor or achieve a control

objective. There is a direct relationship between an entity’s objectives and the internal control it implements

to ensure their achievement. Once objectives are set, it is possible to identify and assess potential events

(risks) that would prevent the achievement of the objectives. Based on this information, management can

develop appropriate responses, which will include the design of internal control.

Internal control objectives can be broadly grouped into four categories:

• Strategic, high-level goals that support the mission of the entity;

• Financial reporting (internal control over fi nancial reporting);

• Operations (operational controls); and

• Compliance with laws and regulations.

Internal control relevant to an audit primarily pertains to financial reporting. This addresses the entity’s

objective of preparing financial statements for external purposes.

Operational controls, such as production and staff scheduling, quality control, and employee compliance with

health and safety requirements, would not normally be relevant to the audit, except where:

52