Page 11 - CCFA Journal - Tenth Issue

P. 11

加中金融 宏观经济 Macro Economy

我们看一下其他的经济指标显示什么样的图景。

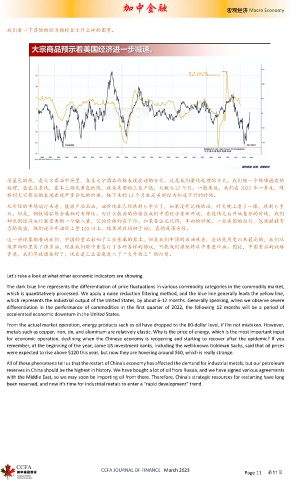

深蓝色的线,是大宗商品市场里,各类大宗商品价格表现波动的分化,这是我们量化处理的方式。我们做一个降噪滤波的

处理,蓝色这条线,基本上领先黄色的线,就是美国的工业产值,大概 6-12 个月。一般来说,我们在 2022 年一季度,观

察到大宗商品的表现出现严重分化的时候,接下来的 12 个月就是美国经济加速下行的时候。

从实际的市场运行来看,能源产品石油,油价现在已经跌到 6 字头了,如果没有记错的话,昨天晚上看了一眼,跌到 6 字

头。但是,铜铁锡铝等金属相对有弹性。为什么能源的价格在我们中国经济重新开放,在疫情之后开始复苏的时候,我们

却见到经济运行最重要的一个输入量,它的价格却在下行。如果各位还记得,年初的时候,一些美国的投行,包括赫赫有

名的高盛,他们说今年油价上望 120 以上,结果现在徘徊于 60,真的是很奇怪。

这一些现象都告诉我们,中国的重启影响了工业金属的需求,但是我们中国的石油库存,应该是历史以来最高的,我们从

俄罗斯那里买了很多油,现在我们跟中东签订了各种各样的协议,可能我们很快将从中东进口油。因此,中国重启的战略

资源,我们早就储备好了,现在是工业金属进入了“大干快上”的行情。

Let's take a look at what other economic indicators are showing.

The dark blue line represents the differentiation of price fluctuations in various commodity categories in the commodity market,

which is quantitatively processed. We apply a noise reduction filtering method, and the blue line generally leads the yellow line,

which represents the industrial output of the United States, by about 6-12 months. Generally speaking, when we observe severe

differentiation in the performance of commodities in the first quarter of 2022, the following 12 months will be a period of

accelerated economic downturn in the United States.

From the actual market operation, energy products such as oil have dropped to the 60-dollar level, if I'm not mistaken. However,

metals such as copper, iron, tin, and aluminum are relatively elastic. Why is the price of energy, which is the most important input

for economic operation, declining when the Chinese economy is reopening and starting to recover after the epidemic? If you

remember, at the beginning of the year, some US investment banks, including the well-known Goldman Sachs, said that oil prices

were expected to rise above $120 this year, but now they are hovering around $60, which is really strange.

All of these phenomena tell us that the restart of China's economy has affected the demand for industrial metals, but our petroleum

reserves in China should be the highest in history. We have bought a lot of oil from Russia, and we have signed various agreements

with the Middle East, so we may soon be importing oil from there. Therefore, China's strategic resources for restarting have long

been reserved, and now it's time for industrial metals to enter a "rapid development" trend.

CCFA JOURNAL OF FINANCE March 2023

Page 11 第11页