Page 13 - CCFA Journal - Tenth Issue

P. 13

加中金融 宏观经济 Macro Economy

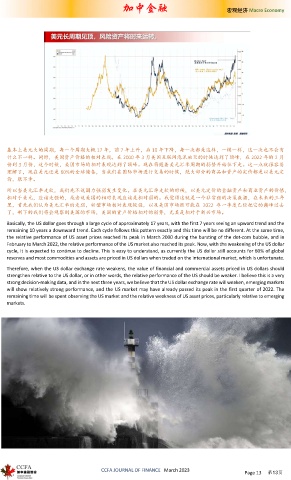

基本上美元大的周期,每一个周期大概 17 年,前 7 年上升,后 10 年下降,每一次都是这样,一模一样,这一次也不会有

什么不一样。同时,美国资产价格的相对表现,在 2000 年 3 月美国互联网泡沫破灭的时候达到了顶峰,在 2022 年的 2 月

份到 3 月份,这个时候,美国市场的相对表现达到了顶峰。现在将随着美元汇率周期的弱势开始往下走。这一点就很容易

理解了,现在美元还是 60%的全球储备,当我们在国际市场进行交易的时候,绝大部分的商品和资产的定价都是以美元定

价,很不幸。

所以当美元汇率走软,我们先不说国力强弱发生变化。在美元汇率走软的时候,以美元定价的金融资产和商业资产的价值,

相对于美元,应该走强的,或者说美国的相对表现应该是相对弱的。我觉得这就是一个非常强的决策数据,在未来的三年

里,首先我们认为美元汇率的走弱,新型市场相对表现较强,以及美国市场很可能在 2022 年一季度已经把它的巅峰过去

了,剩下的我们将会观察到美国的市场,美国的资产价格相对的弱势,尤其是相对于新兴市场。

Basically, the US dollar goes through a large cycle of approximately 17 years, with the first 7 years seeing an upward trend and the

remaining 10 years a downward trend. Each cycle follows this pattern exactly and this time will be no different. At the same time,

the relative performance of US asset prices reached its peak in March 2000 during the bursting of the dot-com bubble, and in

February to March 2022, the relative performance of the US market also reached its peak. Now, with the weakening of the US dollar

cycle, it is expected to continue to decline. This is easy to understand, as currently the US dollar still accounts for 60% of global

reserves and most commodities and assets are priced in US dollars when traded on the international market, which is unfortunate.

Therefore, when the US dollar exchange rate weakens, the value of financial and commercial assets priced in US dollars should

strengthen relative to the US dollar, or in other words, the relative performance of the US should be weaker. I believe this is a very

strong decision-making data, and in the next three years, we believe that the US dollar exchange rate will weaken, emerging markets

will show relatively strong performance, and the US market may have already passed its peak in the first quarter of 2022. The

remaining time will be spent observing the US market and the relative weakness of US asset prices, particularly relative to emerging

markets.

CCFA JOURNAL OF FINANCE March 2023

Page 13 第13页