Page 12 - CCFA Journal - Tenth Issue

P. 12

宏观经济 Macro Economy 加中金融

刚才我们讲到美元,一个国家的汇率,是这个国家相对国力强势的表现之一,很可能是最重要的表现,因为这一个指标反

映的是,一个国家国内和国外货币政策选择的情况,反映了经济增长的情况,以及反映了劳动生产力提高相对变化的情况。

比如中国从 2001 年到 2010 年,我们经历了 10 年的快速入市之后的发展,人民币从 8 点几一直走强走到 6。美元正好是

我们的相反。

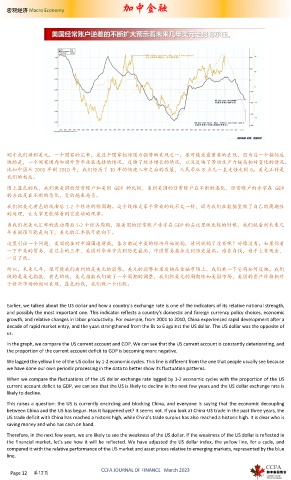

图上蓝色的线,我们做美国的经常账户和美国 GDP 的比较,看到美国的经常账户在不断的恶化,经常账户的赤字在 GDP

的占比是在不断的恶化,变的越来越负。

我们把美元黄色的线滞后 1-2 个经济的短周期。这个线跟大家平常看的线不太一样,因为我们在数据里做了自己的周期性

的处理,让大家更能够看到它波动的规律。

当我们把美元汇率的波动滞后 1-2 个经济周期,跟美国的经常账户赤字在 GDP 的占比里做比较的时候,我们就看到未来几

年美国很可能是向下,美元的汇率很可能向下。

这里引出一个问题,美国现在对中国围追堵截,各方都说中美的经济开始脱钩,请问脱钩了没有呢?好像没有。如果你看

一下中美的贸易,在过去的三年,美国对华赤字达到历史最高,中国贸易盈余达到历史最高。谁在存钱,谁手上有现金,

一目了然。

所以,未来几年,很可能我们看到的是美元的弱势。美元的弱势如果反映在金融市场上,我们看一下它将如何反映。我们

做的是美元指数,黄色的线,美元指数我们做了一个周期的调整,我们把美元的周期性和美国市场,美国的资产价格相对

于新兴市场的相对表现,蓝色的线,我们做一个比较。

Earlier, we talked about the US dollar and how a country's exchange rate is one of the indicators of its relative national strength,

and possibly the most important one. This indicator reflects a country's domestic and foreign currency policy choices, economic

growth, and relative changes in labor productivity. For example, from 2001 to 2010, China experienced rapid development after a

decade of rapid market entry, and the yuan strengthened from the 8s to 6 against the US dollar. The US dollar was the opposite of

us.

In the graph, we compare the US current account and GDP. We can see that the US current account is constantly deteriorating, and

the proportion of the current account deficit to GDP is becoming more negative.

We lagged the yellow line of the US dollar by 1-2 economic cycles. This line is different from the one that people usually see because

we have done our own periodic processing in the data to better show its fluctuation patterns.

When we compare the fluctuations of the US dollar exchange rate lagged by 1-2 economic cycles with the proportion of the US

current account deficit to GDP, we can see that the US is likely to decline in the next few years and the US dollar exchange rate is

likely to decline.

This raises a question: the US is currently encircling and blocking China, and everyone is saying that the economic decoupling

between China and the US has begun. Has it happened yet? It seems not. If you look at China-US trade in the past three years, the

US trade deficit with China has reached a historic high, while China's trade surplus has also reached a historic high. It is clear who is

saving money and who has cash on hand.

Therefore, in the next few years, we are likely to see the weakness of the US dollar. If the weakness of the US dollar is reflected in

the financial market, let's see how it will be reflected. We have adjusted the US dollar index, the yellow line, for a cycle, and

compared it with the relative performance of the US market and asset prices relative to emerging markets, represented by the blue

line.

CCFA JOURNAL OF FINANCE March 2023

Page 12 第12页