Page 29 - CCFA Journal - Third Issue

P. 29

Investment Forum 投资论坛 加中金融

美国核心 CPI 依然在下滑。美国 1 月核心 CPI 延续近 7 个 The U.S. core CPI of in January continued its downward trend

月的下行趋势,并且大幅低于 2%,鲍威尔依然表示美联 for nearly 7 months and was significantly lower than 2%.

储希望看到实际的通胀超过 2%,而不仅是通胀预期,且 Powell still stated that the Fed would like to see actual inflation

认为经济重启后可能出现的通胀上行只是暂时的,对此并 exceeding 2%, and that inflation may occur after the economy

restarts. Such a rise in expectation was only temporary and there

不担忧。失业金人数据改善温和,仍高于去年11月时的低 is no concern about it. The unemployment data has improved

位水平,美国就业市场复苏仍然缓慢。疫情仍拖累服务需 moderately, still higher than the low level in November last year,

求、耐用消费品需求旺盛的格局可持续性也有所弱化。美 and the recovery of the US job market was still slow. The

联储主席鲍威尔在 2 月 10 日发表了题为“Getting Back to a pandemic still dragged down service demand and the

Strong Labor Market”的演讲,指出美国就业和通胀均未 sustainability of strong demand for consumer durables has also

达到目标:在就业目标方面,鲍威尔表示当前就业人数与 weakened. Powell delivered a speech titled “Getting Back to a

去年 2 月仍有 100 万人的差距,永久性失业正在逐渐增多, Strong Labor Market” on February 10, pointing out that both

且考虑到去年 2 月以来离开劳动力市场的人群,实际的失 U.S. employment and inflation have not reached the target. In

terms of employment targets, Powell said that the current

业率接近 10%。

number of jobs compared to that in February last year, there was

另一方面,美国寒潮冲击供给助推油价大涨。油价的大幅 still a gap of 1 million people. The permanent unemployment is

上扬更多受到供给端收缩的直接影响,这些影响因素包括 gradually increasing, while considering the people who have

left the labor market since February last year, the actual

OPEC 减产协议执行力度较好、中东局势动荡和美国寒潮 unemployment rate is close to 10%.

对页岩油产出的冲击。关键问题在于供给因素的可持续性。

On the other hand, the US freezing weather in the south hit

反观中国,和发达国家不同的是,目前还是一个典型的由 supply of oil and boosted oil prices. The sharp rise in oil prices

工业带动服务业,生产带动消费的经济体。这就意味着, was more directly affected by the supply-side contraction. The

中国的经济景气度,实际上会从企业部门经由劳动力市场 factors include the better implementation of OPEC’s production

向居民部门传导。所以,要看中国通胀的长期趋势,看代 reduction agreement, the turmoil in the Middle East and the

表工业品价格的 PPI,要比看代表消费品价格的 CPI 更有 impact of the US cold wave on shale oil output. The key issue

前瞻性。那么,目前这个传导过程进展到什么地步了呢? of oil price is the sustainability of supply.

这里可以关注 CPI 里的一个分项,那就是房租。由于房租 In contrast, China is different from developed countries in that

反映的是中低收入人群的消费能力,也是劳动力成本变化 it is still an economy typically composed of service sectors

的关键影响因素,因此可以充当企业部门和居民部门之间 driven by industry, and consumption by production. This means

的一个桥梁。从去年十月份开始,中国 CPI 中的房租分项 that China’s economic prosperity will actually be transmitted

在环比上已经开始悄悄回升了,这就意味着,中国的通胀 from the corporate sector to the residential sector through the

labor market. Therefore, studying the long-term trend of

压力正慢慢从生产端向消费端扩散。 inflation in China, it would be more worthwhile and forward-

looking to look at the PPI, which represents the prices of

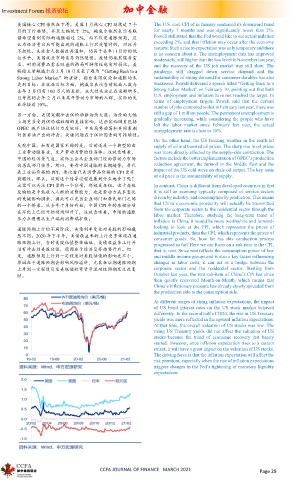

通胀预期上行的不同阶段,美债利率变化对美股的影响截 industrial products, than the CPI, which represents the prices of

然不同。2020 年下半年,美债收益率的上行更多体现在通 consumer goods. So, how far has this conduction process

胀预期上行,当时美股估值整体偏低,美债收益率上行并 progressed so far? Here we can focus on a sub-item in the CPI,

没有冲击到美股估值,原因在于经济复苏趋势开启。但 that is, rent. Since rent reflects the consumption power of low

是,通胀预期上行到一定程度对美股估值的影响也不小, and middle income groups and is also a key factor influencing

原因在于通胀预期会影响风险溢价,尤其在后期通胀预期 changes in labor costs, it can act as a bridge between the

上升到一定程度引发美联储收紧货币流动性预期发生改变 corporate sector and the residential sector. Starting from

时。 October last year, the rent sub-item of China’s CPI has since

then quietly recovered Month-on-Month, which means that

China’s inflationary pressure has already slowly spreaded from

the production side to the consumption side.

At different stages of rising inflation expectations, the impact

of US bond interest rates on the US stock market behaved

differently. In the second half of 2020, the rise in US Treasury

yields was more reflected in the upward inflation expectations.

At that time, the overall valuation of US stocks was low. The

rising US Treasury yields did not affect the valuation of US

stocks because the trend of economic recovery just barely

started. However, once inflation expectation rises to a certain

extent, it will have a great impact on the valuation of US stocks.

The driving force is that the inflation expectation will affect the

risk premium, especially when the rise of inflation expectations

triggers changes in the Fed’s tightening of monetary liquidity

expectations.

CCFA JOURNAL OF FINANCE MARCH 2021 Page 29