Page 15 - CCFA Journal - 8th Issue

P. 15

加中金融 经济热点 Economy hotspots

高度依赖预售的相关风险

实际上,不断扩大的预售比例抬高了房企的杠杆水平,许多房企得以迅速扩张。然而,预售模式也伴随着高昂的成本。

高度依赖预售或令房企面临以下风险:

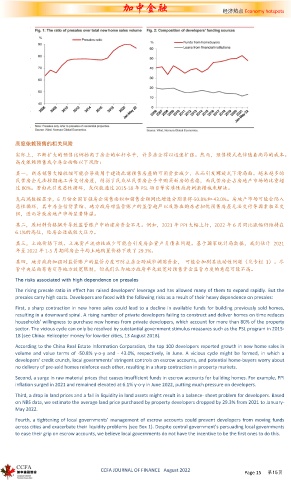

其一,新房销售大幅收缩可能会导致用于建造此前预售房屋的可用资金减少,从而引发螺旋式下滑局面。越来越多的

民营房企无法按期施工并交付房屋,削弱了民众从民营房企手中购买新房的意愿,而民营房企占房地产市场的比重超

过 80%。若由此引发恶性循环,或仅能通过 2015-18 年 PSL 项目等实质性政府刺激措施来解决。

克而瑞数据显示,6 月份全国百强房企销售面积和销售金额同比增速分别录得-50.8%和-43.0%。房地产市场可能会陷入

恶性循环,其中房企信贷紧缩、地方政府对监管账户的监管趋严以及潜在购房者担忧预售房屋无法交付等因素相互交

织,进而导致房地产市场显著降温。

其二,原材料价格飙升导致监管账户中的建房资金不足。例如,2021 年 PPI 大幅上行,2022 年 6 月同比涨幅仍维持在

6.1%的高位,给房企造成较大压力。

其三,土地价格下跌、土地资产流动性减少可能会引发房企资产负债表问题。基于国家统计局数据,我们估计 2021

年至 2022 年 1-5 月期间房企平均土地购置价格下跌了 29.3%。

其四,地方政府加强对监管账户的监管力度可防止房企跨城市调用资金, 可能会加剧其流动性问题(见专栏 1)。尽

管中央层面有意引导地方放宽限制,但我们认为地方政府率先放宽对预售资金监管力度的意愿可能不高。

The risks associated with high dependence on presales

The rising presale ratio in effect has raised developers’ leverage and has allowed many of them to expand rapidly. But the

presales carry high costs. Developers are faced with the following risks as a result of their heavy dependence on presales:

First, a sharp contraction in new home sales could lead to a decline in available funds for building previously sold homes,

resulting in a downward spiral. A rising number of private developers failing to construct and deliver homes on time reduces

households’ willingness to purchase new homes from private developers, which account for more than 80% of the property

sector. The vicious cycle can only be resolved by substantial government stimulus measures such as the PSL program in 2015-

18 (see China: Helicopter money for low-tier cities, 13 August 2018).

According to the China Real Estate Information Corporation, the top 100 developers reported growth in new home sales in

volume and value terms of -50.8% y-o-y and - 43.0%, respectively, in June. A vicious cycle might be formed, in which a

developers’ credit crunch, local governments’ stringent controls on escrow accounts, and potential home-buyers worry about

no delivery of pre-sold homes reinforce each other, resulting in a sharp contraction in property markets.

Second, a surge in raw material prices that causes insufficient funds in escrow accounts for building homes. For example, PPI

inflation surged in 2021 and remained elevated at 6.1% y-o-y in June 2022, putting much pressure on developers.

Third, a drop in land prices and a fall in liquidity in land assets might result in a balance- sheet problem for developers. Based

on NBS data, we estimate the average land price purchased by property developers dropped by 29.3% from 2021 to January-

May 2022.

Fourth, a tightening of local governments’ management of escrow accounts could prevent developers from moving funds

across cities and exacerbate their liquidity problems (see Box 1). Despite central government’s persuading local governments

to ease their grip on escrow accounts, we believe local governments do not have the incentive to be the first ones to do this.

CCFA JOURNAL OF FINANCE August 2022 Page 15 第15页