Page 43 - CCFA Journal - 8th Issue

P. 43

加中金融 合规 Compliance

The CSRC and State Council Draft Rules

In this last part, we examine the most recent wording from the CSRC and State Council.

On December 24th 2021, the CSRC in conjunction with the relevant State Council departments released a set of draft rules to

“promote lawful use of overseas capital markets by domestic companies to achieve sound development”. It constitutes three

parts, and we encourage interested readers to go through the filing. Here, we provide a summary of our interpretation.

What we glean from a reading of the draft rules is the overarching spirit to enhance policy clarity. Through this, the authorities are

aiming for more capital market stability and more predictable regulatory environment for listings (i.e. avoiding cases like Didi).

The draft rules started with recognizing that offshore listings have played a positive role for Chinese companies:

“Overseas listings have played a positive role in supporting Chinese companies to utilize foreign capital, enhance corporate

governance, and deeply integrate into the global economy”

The spirit of the draft is not to ban or discourage offshore listings:

“We will strive to maintain effective channels for overseas capital-raising, and provide companies with clear, transparent and

operable rules for overseas listings, and a more stable and predictable institutional environment.”

The drafts address some important areas, notably the much-needed strengthening of regulatory coordination both within China

(between CSRC and other relevant State Council departments) and cross-border (between China CSRC and US SEC):

“In addition, the CSRC will support and cooperate with relevant authorities to jointly clarify the rules and regulations of certain

sectors, in order to enhance policy predictability.”

In addition, the documents touch on the clarification of legal responsibilities – for example, what the consequences will be for

companies that fail to perform the necessary filing procedures (as has been the case with Didi). The circumstances under which

offshore listings will not be allowed is also mentioned explicitly:

“The Provisions forbids overseas listings that are prohibited by specific laws and regulations, constitute threat to national security,

involve material ownership disputes, or involve criminal offenses. No extra thresholds or conditions are placed otherwise,

supporting domestic companies’ lawful use of overseas capital markets to finance their development.”

While the draft does not go into detail on each of these conditions, the efforts are nonetheless laudable as far as setting a

common language which can serve as starting point of consensus between regulators and the private sector.

What’s also interesting is that the documents mentioned protecting the “legitimate interests of foreign investors” twice. Yes, the

phrase “legitimate interests of foreign investors” have found itself into a Chinese State Council legal document. Make of it what

you will, but it’s interesting to see.

There is also a statement about dividend payments:

“Domestic companies that seek to offer and list securities in overseas markets can raise funds and pay dividend in foreign

currency or Chinese Yuan(RMB)”

Foreign investors have long expressed skepticism regarding the ability of Chinese companies to return profit, claiming that the

rules are vague. It is true that Chinese companies do require official approvals to return profit to offshore investors. But there is

good track record of them having done so. Recently we have seen a step up in shareholder returns: Alibaba has repurchased $9.6

billion of its US-listed shares during its fiscal year (April 2021 to March 2022), while Baidu repurchased $2.9b since 2020. Tencent

has paid dividend every year, and dividend per share has grown at 21.6% CAGR since 2005, with its most recent payments in 2022

and 2021 totaling $2b each. NetEase and others also pay dividend consistently.

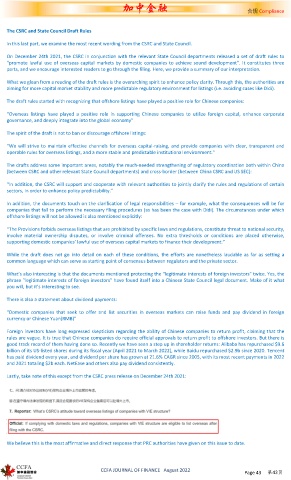

Lastly, take note of this except from the CSRC press release on December 24th 2021:

We believe this is the most affirmative and direct response that PRC authorities have given on this issue to date.

CCFA JOURNAL OF FINANCE August 2022 Page 43 第43页