Page 53 - FY21_LawsonAcademy_FacultyHandbook

P. 53

• Faculty is to lead students in an orderly fashion.

• Wait until all students are seated before leaving the lunch table.

• Maintain a quiet, orderly table. Do not allow students to speak loudly, throw food or

display disruptive behaviors.

• Assist students with the clean-up and proper discarding of all items.

• Line students up by table as directed by the Cafeteria Supervisor.

Pay Days

Paydays are scheduled once monthly on the last business day of the month. Payroll is computed

th

th

using the 25 day of the prior month to the 24 day of the current month. The Lawson Academy’s

payroll is direct deposited into the account(s) you identify in your personnel file.

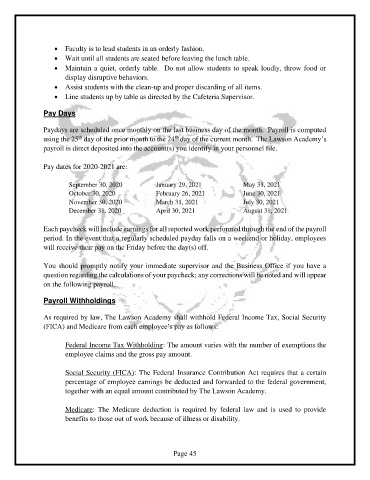

Pay dates for 2020-2021 are:

September 30, 2020 January 29, 2021 May 31, 2021

October 30, 2020 February 26, 2021 June 30, 2021

November 30, 2020 March 31, 2021 July 30, 2021

December 31, 2020 April 30, 2021 August 31, 2021

Each paycheck will include earnings for all reported work performed through the end of the payroll

period. In the event that a regularly scheduled payday falls on a weekend or holiday, employees

will receive their pay on the Friday before the day(s) off.

You should promptly notify your immediate supervisor and the Business Office if you have a

question regarding the calculations of your paycheck; any corrections will be noted and will appear

on the following payroll.

Payroll Withholdings

As required by law, The Lawson Academy shall withhold Federal Income Tax, Social Security

(FICA) and Medicare from each employee’s pay as follows:

Federal Income Tax Withholding: The amount varies with the number of exemptions the

employee claims and the gross pay amount.

Social Security (FICA): The Federal Insurance Contribution Act requires that a certain

percentage of employee earnings be deducted and forwarded to the federal government,

together with an equal amount contributed by The Lawson Academy.

Medicare: The Medicare deduction is required by federal law and is used to provide

benefits to those out of work because of illness or disability.

Page 45