Page 574 - Bahrain Gov Annual Reports (I)_Neat

P. 574

*i4

572 -2-

V»j un alcoholic liquors and

tobacco i5/b ad valorem

^b) un specified commodities

known as "luxury

articles" it#

un any ether commodity

class (c; induces the necessities ol me •»

that is focustuffs ana non silken piecegooas

for clothing purposes.

oince a large proportion of the population are

very poor, it is desirable that cereals shouia

suffer as iow a auty as is possible.

There is a small tariff in iorce upon produce

brought tc Bahrain by native craft. The reason

for this is to ensure tc the illiterate native

the' exact amount of autv he is called upon to

pay ana therefore this tariff is upon a quan

titative besis. The theory of this tariff is

upon a basis of five per cent aa valorem; it

is open to revision from time tc time. It

was" last revised in 1^25 when the opinion was

expresseu that such revision should not be made

too frequently, ana every tenth year might be

suitable.

iruring the cast decade the value of produce,

especially foodstuffs, has considerably decreased:

ana therefore l consider it desirable to revise this

tariff durmc the present year, ana such revision

win be submitted in due course upon a valuation

of 5*p ad valorem.

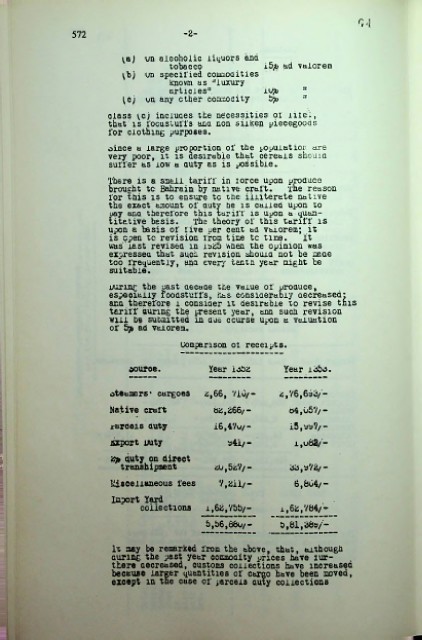

Uompanson oi receipts.

source. fear io52 Year i65o.

steamers* cargoes £,66, Yiu/- 2,76,6s>3/'-

Native craft 62,266/- 04,057/ -

rarceis duty i6,47u/-

jsxport uuty o4i /- i,u8a/-

i cp duty on direct

d transhipment 20,527/- 60,372/-

Liieceiianeous fees 7,2ii/- 6,604/-

Import Yard

cciiections 1,62,755/- 1,62,764/'-

5,b6,66o/- 5,61,66»/-

It may be remarked from the above, that, although

curing the past year commoaity prices have iut-

there aecreased, customs collections have increased

because larger quantities of cargo have been moved,

except in tne case of parcels auty collections