Page 93 - VIRANSH COACHING CLASSES

P. 93

networks that consists of private, public, academic, business, and government networks of

local to global scope, linked by a broad array of electronic, wireless, and services, such as the

inter-linked hypertext documents and applications of the World Wide Web (WWW), electronic

mail and file sharing.

c. Email:

Electronic mail (email or e-mail) is a method of exchanging mail between people using

electronic devices.Today's email systems are based on a store-and-forward model. Email

servers accept, forward, deliver, and store messages. Neither the users nor their computers

are required to be online simultaneously; they need to connect only briefly, typically to a mail

server or a webmail interface for as long as it takes to send or receive messages.

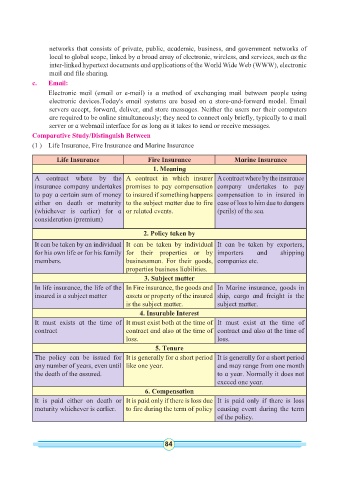

Comparative Study/Distinguish Between

(1 ) Life Insurance, Fire Insurance and Marine Insurance

Life Insurance Fire Insurance Marine Insurance

1. Meaning

A contract where by the A contract in which insurer A contract where by the insurance

insurance company undertakes promises to pay compensation company undertakes to pay

to pay a certain sum of money to insured if something happens compensation to in insured in

either on death or maturity to the subject matter due to fire case of loss to him due to dangers

(whichever is earlier) for a or related events. (perils) of the sea.

consideration (premium)

2. Policy taken by

It can be taken by an individual It can be taken by individual It can be taken by exporters,

for his own life or for his family for their properties or by importers and shipping

members. businessman. For their goods, companies etc.

properties business liabilities.

3. Subject matter

In life insurance, the life of the In Fire insurance, the goods and In Marine insurance, goods in

insured is a subject matter assets or property of the insured ship, cargo and freight is the

is the subject matter. subject matter.

4. Insurable Interest

It must exists at the time of It must exist both at the time of It must exist at the time of

contract contract and also at the time of contract and also at the time of

loss. loss.

5. Tenure

The policy can be issued for It is generally for a short period It is generally for a short period

any number of years, even until like one year. and may range from one month

the death of the assured. to a year. Normally it does not

exceed one year.

6. Compensation

It is paid either on death or It is paid only if there is loss due It is paid only if there is loss

maturity whichever is earlier. to fire during the term of policy causing event during the term

of the policy.

84 85