Page 94 - VIRANSH COACHING CLASSES

P. 94

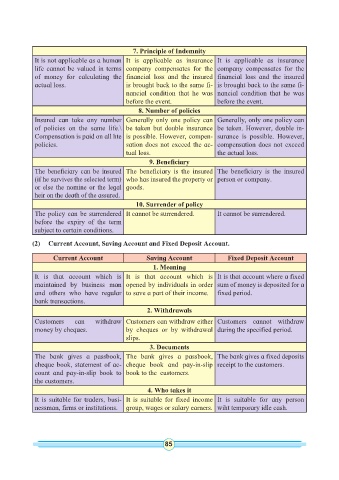

7. Principle of Indemnity

It is not applicable as a human It is applicable as insurance It is applicable as insurance

life cannot be valued in terms company compensates for the company compensates for the

of money for calculating the financial loss and the insured financial loss and the insured

actual loss. is brought back to the same fi- is brought back to the same fi-

nancial condition that he was nancial condition that he was

before the event. before the event.

8. Number of policies

Insured can take any number Generally only one policy can Generally, only one policy can

of policies on the same life.\ be taken but double insurance be taken. However, double in-

Compensation is paid on all hte is possible. However, compen- surance is possible. However,

policies. sation does not exceed the ac- compensation does not exceed

tual loss. the actual loss.

9. Beneficiary

The beneficiary can be insured The beneficiary is the insured The beneficiary is the insured

(if he survives the selected term) who has insured the property or person or company.

or else the nomine or the legal goods.

heir on the death of the assured.

10. Surrender of policy

The policy can be surrendered It cannot be surrendered. It cannot be surrendered.

before the expiry of the term

subject to certain conditions.

(2) Current Account, Saving Account and Fixed Deposit Account.

Current Account Saving Account Fixed Deposit Account

1. Meaning

It is that account which is It is that account which is It is that account where a fixed

maintained by business man opened by individuals in order sum of money is deposited for a

and others who have regular to save a part of their income. fixed period.

bank transactions.

2. Withdrawals

Customers can withdraw Customers can withdraw either Customers cannot withdraw

money by cheques. by cheques or by withdrawal during the specified period.

slips.

3. Documents

The bank gives a passbook, The bank gives a passbook, The bank gives a fixed deposits

cheque book, statement of ac- cheque book and pay-in-slip receipt to the customers.

count and pay-in-slip book to book to the customers.

the customers.

4. Who takes it

It is suitable for traders, busi- It is suitable for fixed income It is suitable for any person

nessman, firms or institutions. group, wages or salary earners. wiht temporary idle cash.

84 85