Page 691 - ACFE Fraud Reports 2009_2020

P. 691

Anti-Fraud Controls in Small Businesses

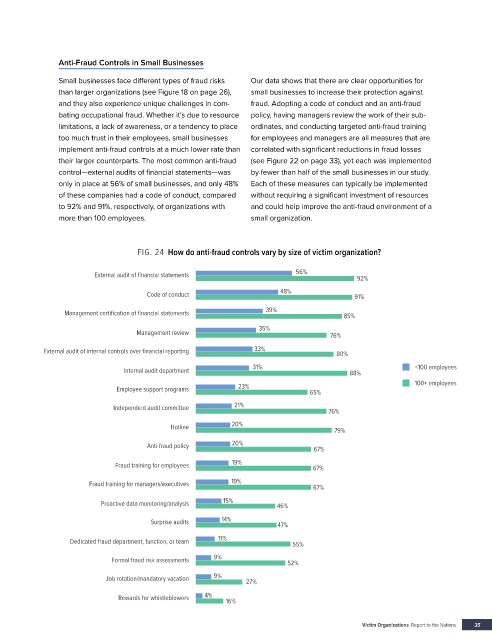

Small businesses face different types of fraud risks Our data shows that there are clear opportunities for

than larger organizations (see Figure 18 on page 26), small businesses to increase their protection against

and they also experience unique challenges in com- fraud. Adopting a code of conduct and an anti-fraud

bating occupational fraud. Whether it’s due to resource policy, having managers review the work of their sub-

limitations, a lack of awareness, or a tendency to place ordinates, and conducting targeted anti-fraud training

too much trust in their employees, small businesses for employees and managers are all measures that are

implement anti-fraud controls at a much lower rate than correlated with significant reductions in fraud losses

their larger counterparts. The most common anti-fraud (see Figure 22 on page 33), yet each was implemented

control—external audits of financial statements—was by fewer than half of the small businesses in our study.

only in place at 56% of small businesses, and only 48% Each of these measures can typically be implemented

of these companies had a code of conduct, compared without requiring a significant investment of resources

to 92% and 91%, respectively, of organizations with and could help improve the anti-fraud environment of a

more than 100 employees. small organization.

FIG. 24 How do anti-fraud controls vary by size of victim organization?

External audit of financial statements 56% 92%

Code of conduct 48% 91%

Management certification of financial statements 39% 85%

35%

Management review 76%

External audit of internal controls over financial reporting 33% 80%

Internal audit department 31% 88% <100 employees

Employee support programs 23% 65% 100+ employees

Independent audit committee 21% 76%

Hotline 20% 79%

Anti-fraud policy 20% 67%

Fraud training for employees 19% 67%

Fraud training for managers/executives 19% 67%

Proactive data monitoring/analysis 15% 46%

Surprise audits 14% 47%

Dedicated fraud department, function, or team 11% 55%

Formal fraud risk assessments 9% 52%

Job rotation/mandatory vacation 9% 27%

Rewards for whistleblowers 4% 16%

Victim Organizations Report to the Nations 35