Page 4 - TWIMS Posters 2023

P. 4

A FRAMEWORK FOR Background Lessons from the Largest African Sugar Producing

Countries

EXPANDING AND African agriculture can be expected to expand agreements are likely to keep intra-continental The study focused on the structure and status quo research, disseminate useful findings, and share

trade relatively low over the next decade. Yet

over the next few decades, in line with

opportunities exist to expand sugar industries to

population growth. The production of staple

foods, including sugar, is expected to rise

countries, namely, Egypt, South Africa, Eswatini,

substantially to meet the needs of more than a serve local and regional markets. of sugar industry production in six African improved crop varieties with their sugar growers.

There are examples of collaborations between

This report reviews the status quo African context

HARMONISING SUGAR quarter of the world’s population that is and recommends eight policies for investors sugar producers in 2020 and together make up local and international research institutes.

Kenya and Morocco. These were Africa’s largest

expected to live on the continent by 2050. Africa

looking to expand sugar production in Africa. The

Every country’s highest regulatory body is their

roughly 64% of African sugar production out of an

currently produces 6.5% of the world’s sugar,

with most of this being supplied by six countries policy recommendations are based on what has estimated total of 11.47 million tonnes. Ministry of Agriculture, whereas other regulatory

worked in the past, to create established sugar

bodies differ greatly. Price-setting intermediaries

INDUSTRIES WITHIN AFRICA barriers and slow progress with free trade industries, whilst considering the current regional Kenya, Morocco and Uganda all have well (independent, except for the state in Egypt) exist

The sugar sectors in Egypt, South Africa, Eswatini,

with established sugar industries. Natural trade

business environments.

between the millers and growers. Price-setting

established structures. Both the state dominated

intermediaries are essential to streamline the

Methodology

industries (examples in Eswatini and Egypt) and

privately run industries (examples in Uganda and

consistent flow of sugar crops to the mills during

South Africa) are supported by bargaining supply chain, create price stability, and allow a

structures (between millers and growers) and harvest seasons. All regions have large local

The study starts with an overview of how African supporting organisations and agricultural ministries, research aimed at improving the operations and markets for sugar and sugar products, except for

countries fit into global sugar production and trade, policies, trade, and tariffs. Key industry experts were outputs of growers, millers, and other value- Eswatini, which exports to the geographically

to assess the relative scale of production, local interviewed to direct the research focus and identify adding activities. All six countries conduct local adjacent, South African market.

markets, and growth trends. Data and reports on the relevant data. The study ends with policy

other six countries with large production were recommendations for sugar industrialisation in

reviewed to examine sugar industry structures, existing smaller African markets. Policy Recommendations

AUTHORS: Findings The future growth of African sugar industries will oversees a predictable Recoverable Value

payments system. The payment system must

certainly rely on the expansion and opening of

incentivise quality and efficiency and allow for

current small-scale markets. Taking lessons from the

more mature markets in Egypt, South Africa, monthly price changes over the harvest season.

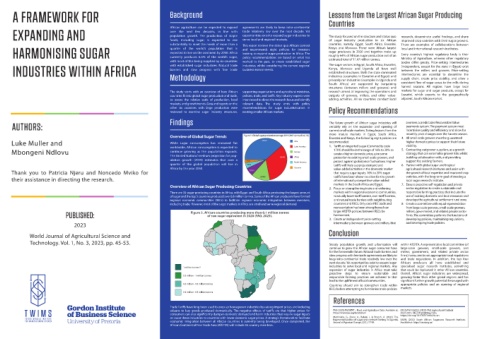

Overview of Global Sugar Trends Figure 1. Global sugar production average 2019-2021 (annual kt) [14] Eswatini and Kenya, the following eight policies are 4. All small-scale growers must be guaranteed

Luke Muller and While sugar consumption has remained flat 65667 Asia recommended: higher domestic prices to support their future

viability.

worldwide, African consumption is expected to Latin America 1. Tariffs on imported sugar (Commodity code 5. Contracting outgrower suppliers, as a growth

Mbongeni Ndlovu continue growing as the population expands. Europe 1701) should be in the range of 16% to 20% to strategy, that can externalise grower risks whilst

create a higher domestic price, give some

The United Nations’ medium projection for pop- 56905 Africa protection to existing small-scale growers, and building collaboration with, and providing

ulation growth (2019) estimates that over a 4207 protect against global price fluctuations. Higher support for, existing farmers.

quarter of the global population will live in 7609 North America tariffs will likely suppress demand and 6. Partner with global sugar and tropical

Africa by the year 2050. Oceania value-added activities in the domestic market agricultural research institutes and assist with

Thank you to Patricia Njeru and Noncedo Mviko for 11104 that require sugar inputs. 16% to 20% sugar the growth of local expertise and improved crop

their assistance in directing the research. 24488 tariffs have been shown to allow for the growth varieties, with the long-term goal of creating a

local sugar research institute.

of internationally competitive value-added

markets in the South Africa and Egypt. 7. Ensure proactive self-regulation and private

Overview of African Sugar Producing Countries

2. Focus on strengthening trade and widening sector regulation to create sustainable and

There are 35 sugar-producing countries in Africa, with Egypt and South Africa producing the largest amount markets within regional economic communities. responsible farming practices that include the

of sugar and the top 5 countries produced over 6.8 million tonnes. Some of the African producers have formed Gradually lower tariff barriers, non-tariff barriers, use of existing domestic and local resources and

regional economic communities (RECs) to facilitate regional economic integration between members, and natural trade barriers with neighbouring develops the agricultural settlement rural zone.

including trade. However, most of the sugar markets in Africa are small and serve regional demand. countries and RECs. Only once REC trade and 8. Create a committee with equal representation

representation has been strengthened can from large-scale growers, small-scale growers,

PUBLISHED: Figure 2. African countries producing more than 0.1 million tonnes larger AfCFTA policies between RECs be millers, government, and related private sector

harmonised.

firms. The committee performs the functions of

of raw sugar equivalent in 2020 (FAO, 2023).

3. Create an independent price-setting developing policies, maintaining regulations,

2023 intermediary, between growers and millers, that and developing trade policies.

Conclusion

World Journal of Agricultural Science and

Technology. Vol. 1, No. 3, 2023, pp. 45-53. Steady population growth, and urbanisation will within AfCFTA. A representative local committee (of

continue to grow the African sugar consumer base large-scale growers, small-scale growers, and

for the foreseeable future. Natural trade barriers and millers, government, and related private sector

slow progress with free trade agreements are likely to firms) is required to set appropriate local regulations

keep intra-continental trade relatively low over the and trade regulations. In addition, the top four

next decade. Yet opportunities exist to expand sugar African producers all have established and

industries to serve local and regional markets. Any specialised sugar research institutes, something

1 million tonnes *

expansion of sugar industries in Africa must take that could be replicated in other African countries.

proactive steps to ensure sustainable and Overall, Africa’s sugar industries are widespread,

0.5 million - 1 million tonnes

responsible farming practices are adhered to that growing faster than other global regions and has

lead to the upliftment of local communities. significant further growth potential if managed with

0.3 million - 0.5 million tonnes appropriate policies and an opening of regional

Countries should aim to strengthen trade within

RECs before attempting to harmonise trade policies markets.

0.1 million - 0.3 million tonnes

References

Trade Tariffs have long been used to prop up homegrown industries by raising import prices and inducing

citizens to buy goods produced domestically. The negative effects of tariffs are that higher prices for FAO (2023) FAOSTAT – Food and Agriculture Data. Available at: OECD/FAO (2022), OECD-FAO Agricultural Outlook

consumers can also significantly dampen domestic demand and harm industries that require sugar inputs https://www.fao.org/faostat/en/ 2022-2031, OECD Publishing, Paris,

https://doi.org/10.1787/f1b0b29c-en.

or cause these industries to countries with lower domestic sugar prices. A strategic framework to facilitate Martiniello, G., Owor, A., Bahati, I., & Branch, A. (2022). The

economic integration between all African countries is currently being developed. Once completed, the fragmented politics of sugarcane contract farming in Uganda. SASRI, (2022) South African Sugarcane Research Institute.

Journal of Agrarian Change, 22(1), 77-96.

Available at: https://sasri.org.za/

African Continental Free Trade Area (AfCFTA) will include 55 country members.