Page 74 - GB SUBJECTS NEW - ALL PAGE NO

P. 74

`

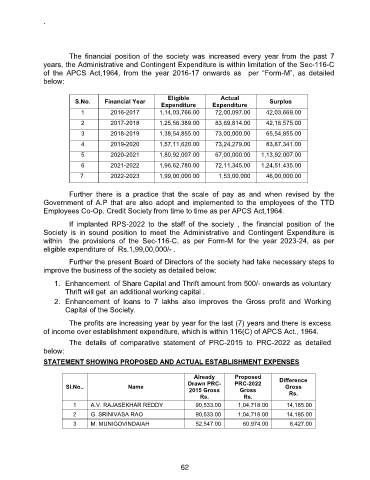

The financial position of the society was increased every year from the past 7

years, the Administrative and Contingent Expenditure is within limitation of the Sec-116-C

of the APCS Act,1964, from the year 2016-17 onwards as per “Form-M”, as detailed

below:

Eligible Actual

S.No. Financial Year Surplus

Expenditure Expenditure

1 2016-2017 1,14,03,766.00 72,00,097.00 42,03,669.00

2 2017-2018 1,25,56,389.00 83,69,814.00 42,16,575.00

3 2018-2019 1,38,54,855.00 73,00,000.00 65,54,855.00

4 2019-2020 1,57,11,620.00 73,24,279.00 83,87,341.00

5 2020-2021 1,80,92,007.00 67,00,000.00 1,13,92,007.00

6 2021-2022 1,96,62,780.00 72,11,345.00 1,24,51,435.00

7. 2022-2023 1,99,00,000.00 1,53,00,000 46,00,000.00

Further there is a practice that the scale of pay as and when revised by the

Government of A.P that are also adopt and implemented to the employees of the TTD

Employees Co-Op. Credit Society from time to time as per APCS Act,1964.

If implanted RPS-2022 to the staff of the society , the financial position of the

Society is in sound position to meet the Administrative and Contingent Expenditure is

within the provisions of the Sec-116-C, as per Form-M for the year 2023-24, as per

eligible expenditure of Rs.1,99,00,000/- .

Further the present Board of Directors of the society had take necessary steps to

improve the business of the society as detailed below:

1. Enhancement of Share Capital and Thrift amount from 500/- onwards as voluntary

Thrift will get an additional working capital .

2. Enhancement of loans to 7 lakhs also improves the Gross profit and Working

Capital of the Society.

The profits are increasing year by year for the last (7) years and there is excess

of income over establishment expenditure, which is within 116(C) of APCS Act., 1964.

The details of comparative statement of PRC-2015 to PRC-2022 as detailed

below:

STATEMENT SHOWING PROPOSED AND ACTUAL ESTABLISHMENT EXPENSES

Already Proposed Difference

Drawn PRC- PRC-2022

Sl.No.. Name Gross

2015 Gross Gross

Rs. Rs. Rs.

1 A.V. RAJASEKHAR REDDY 90,533.00 1,04,718.00 14,185.00

2 G. SRINIVASA RAO 90,533.00 1,04,718.00 14,185.00

3 M. MUNIGOVINDAIAH 52,547.00 60,974.00 8,427.00

62