Page 10 - LatAmOil Week 37 2021

P. 10

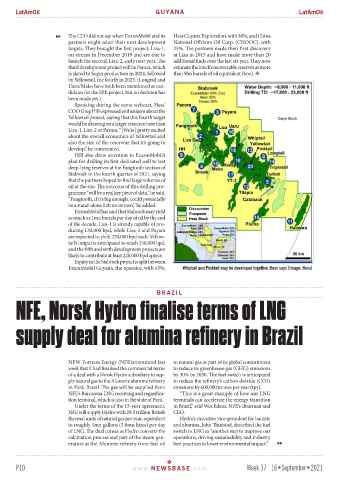

LatAmOil GUYANA LatAmOil

The CEO did not say when ExxonMobil and its Hess Guyana Exploration, with 30%; and China

partners might select their next development National Offshore Oil Corp. (CNOOC), with

targets. They brought the first project, Liza-1, 25%. The partners made their first discovery

on stream in December 2019 and are due to at Liza in 2015 and have made more than 20

launch the second, Liza-2, early next year. The additional finds over the last six year. They now

third development project will be Payara, which estimate the block’s recoverable reserves at more

is slated to begin production in 2024, followed than 9bn barrels of oil equivalent (boe).

by Yellowtail, the fourth in 2025. (Longtail and

Uaru/Mako have both been mentioned as can-

didates for the fifth project, but no decision has

been made yet.)

Speaking during the same webcast, Hess’

COO Greg Hill expressed enthusiasm about the

Yellowtail project, saying that this fourth target

would be drawing on a larger resource base than

Liza-1, Liza-2 or Payara. “[We’re] pretty excited

about the overall economics of Yellowtail and

also the size of the reservoir that it’s going to

develop,” he commented.

Hill also drew attention to ExxonMobil’s

plan for drilling its first dedicated well to test

deep-lying reserves at the Fangtooth section of

Stabroek in the fourth quarter of 2021, saying

that the partners hoped to find large volumes of

oil at the site. The outcome of this drilling pro-

gramme “will be a real key piece of data,” he said.

“Fangtooth, if it’s big enough, could potentially

be a stand-alone hub on its own,” he added.

ExxonMobil has said that Stabroek may yield

as much as 1mn barrels per day of oil by the end

of the decade. Liza-1 is already capable of pro-

ducing 120,000 bpd, while Liza-2 and Payara

are expected to yield 220,000 bpd each. Yellow-

tail’s output is anticipated to reach 250,000 bpd,

and the fifth and sixth development projects are

likely to contribute at least 220,000 bpd apiece.

Equity in the Stabroek project is split between

ExxonMobil Guyana, the operator, with 45%; Whiptail and Pinktail may be developed together, Hess says (Image: Hess)

BRAZIL

NFE, Norsk Hydro finalise terms of LNG

supply deal for alumina refinery in Brazil

NEW Fortress Energy (NFE)announced last to natural gas as part of its global commitment

week that it had finalised the commercial terms to reduce its greenhouse gas (GHG) emissions

of a deal with a Norsk Hydro subsidiary to sup- by 30% by 2030. The fuel switch is anticipated

ply natural gas to the Alunorte alumina refinery to reduce the refinery’s carbon dioxide (CO2)

in Pará, Brazil. The gas will be supplied from emissions by 600,000 tonnes per year (tpy).

NFE’s Barcarena LNG receiving and regasifica- “This is a great example of how our LNG

tion terminal, which is also in the state of Pará. terminals can accelerate the energy transition

Under the terms of the 15-year agreement, in Brazil,” said Wes Edens, NFE’s chairman and

NFE will supply Hydro with 29.5 trillion British CEO.

thermal units of natural gas per year, equivalent Hydro’s executive vice-president for bauxite

to roughly 1mn gallons (3.8mn litres) per day and alumina, John Thuestad, described the fuel

of LNG. The deal comes as Hydro converts the switch to LNG as “another step to improve our

calcination process and part of the steam gen- operations, driving sustainability and industry

eration at the Alunorte refinery from fuel oil best practices to lower environmental impact.”

P10 www. NEWSBASE .com Week 37 16•September•2021