Page 21 - NILE EXPLORER

P. 21

East Africa

Five East African

Countries in U.S.$100

Billion Debt Trap

East African Community (EAC) is composed

of six countries in eastern Africa:

Burundi, Kenya, Rwanda, South Sudan,

rapid build-up of loans has East Africa Community is explained by Tanzania, and Uganda.

p

A ushed East African countries the external debts of the member states.

close to a debt crisis. Five East African

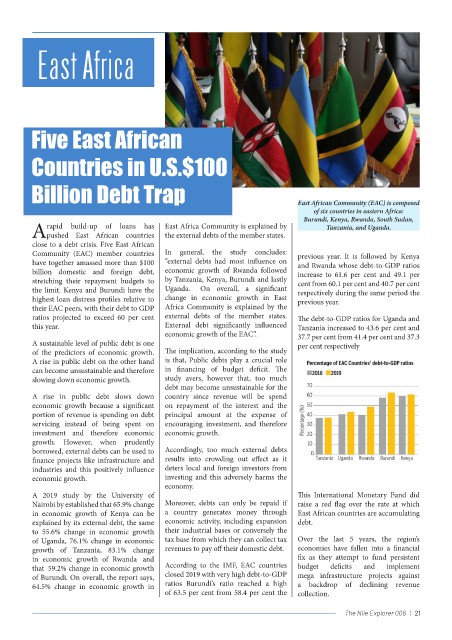

Community (EAC) member countries In general, the study concludes: previous year. It is followed by Kenya

have together amassed more than $100 “external debts had most influence on and Rwanda whose debt-to-GDP ratios

billion domestic and foreign debt, economic growth of Rwanda followed increase to 61.6 per cent and 49.1 per

stretching their repayment budgets to by Tanzania, Kenya, Burundi and lastly cent from 60.1 per cent and 40.7 per cent

the limit. Kenya and Burundi have the Uganda. On overall, a significant respectively during the same period the

highest loan distress profiles relative to change in economic growth in East previous year.

their EAC peers, with their debt to GDP Africa Community is explained by the

ratios projected to exceed 60 per cent external debts of the member states. The debt-to-GDP ratios for Uganda and

this year. External debt significantly influenced Tanzania increased to 43.6 per cent and

economic growth of the EAC”. 37.7 per cent from 41.4 per cent and 37.3

A sustainable level of public debt is one per cent respectively

of the predictors of economic growth. The implication, according to the study

A rise in public debt on the other hand is that, Public debts play a crucial role

can become unsustainable and therefore in financing of budget deficit. The

slowing down economic growth. study avers, however that, too much

debt may become unsustainable for the

A rise in public debt slows down country since revenue will be spend

economic growth because a significant on repayment of the interest and the

portion of revenue is spending on debt principal amount at the expense of

servicing instead of being spent on encouraging investment, and therefore

investment and therefore economic economic growth.

growth. However, when prudently

borrowed, external debts can be used to Accordingly, too much external debts

finance projects like infrastructure and results into crowding out effect as it

industries and this positively influence deters local and foreign investors from

economic growth. investing and this adversely harms the

economy.

A 2019 study by the University of This International Monetary Fund did

Nairobi by established that 65.9% change Moreover, debts can only be repaid if raise a red flag over the rate at which

in economic growth of Kenya can be a country generates money through East African countries are accumulating

explained by its external debt, the same economic activity, including expansion debt.

to 55.6% change in economic growth their industrial bases or conversely the

of Uganda, 76.1% change in economic tax base from which they can collect tax Over the last 5 years, the region’s

growth of Tanzania, 83.1% change revenues to pay off their domestic debt. economies have fallen into a financial

in economic growth of Rwanda and fix as they attempt to fund persistent

that 59.2% change in economic growth According to the IMF, EAC countries budget deficits and implement

of Burundi. On overall, the report says, closed 2019 with very high debt-to-GDP mega infrastructure projects against

64.5% change in economic growth in ratios Burundi’s ratio reached a high a backdrop of declining revenue

of 63.5 per cent from 58.4 per cent the collection.

The Nile Explorer 008 | 21