Page 90 - Insurance Statistics 2021

P. 90

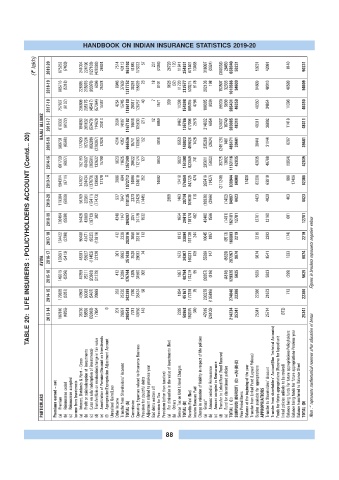

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

(? lakh) 2019-20 975253 (7403) 241004 224190 (127103) (420089) 26624 7514 43113 963102 41885 176323 57 231 (2346) 26720 120 11841 254831 671407 13468 316097 (3324) (368058) 28450 658040 50231 50231 42091 8140 50231

2018-19 885716 (5318) 226695 215976 (83076) 6096 25078 8946 37639 1317752 30291 155829 23 18 8101 6626 (32) 11720 212577 533215 9178 282136 198 153507 32333 1010566 94609 94609 48010 46599 94609

2017-18 757837 (6107) 206609 295175 (45417) (57364) 15447 4254 15745 1186180 20317 120757 40 7 1571 309 11398 154398 805355 4794 180385 (809) (9933) 5639 985431 46350 46350 34954 11396 46350

BAJAJ ALLIANZ 2016-17 618332 (6122) 194080 261632 (53470) 114628 20413 3504 14187 1167182 14644 105630 (21) 12 6059 9462 135786 617006 2976 214902 6854 124607 16740 983085 48311 48311 36892 11418 48311

TABLE 20: LIFE INSURERS : POLICYHOLDERS ACCOUNT (Contd... 20)

2015-16 589731 (6560) 177420 197224 (89288) (228387) 17824 4214 4357 666536 15741 110863 152 4614 9553 140923 499826 1428 235206 (2624) (249125) 1461 486171 39441 39441 31144 8297 39441

2014-15 601730 (6927) 152193 484837 (39561) 132632 15798 5023 11625 1357349 20622 112174 127 8653 9822 151398 823049 741 295611 (5902) 35725 13892 1163116 42835 42835 48789 (5954) 42835

2013-14 584314 (6711) 147827 324434 (137970) 139956 17170 0 2998 694 1072712 14896 134610 252 14692 12418 176869 847725 474 295419 (1427) (311246) 830944 64900 17406 82306 63910 989 17406 82306

2019-20 119364 (5859) 56769 32561 (15411) (77473) 537 7647 118135 2373 23426 (1445) 2898 1463 28714 109038 116 (19839) (2866) (1452) 84997 4423 4423 4020 403 4423

2018-19 126494 (5500) 54428 42889 (19713) 302 4249 1147 204297 2051 24178 1532 1654 29414 118174 402 43400 1586 (1461) 162101 12781 12781 12180 601 12781

2017-18 134422 (5290) 50408 42471 (9025) (12819) 412 2339 202916 3659 28310 113 1813 33894 161139 244 10045 1887 (6513) 166803 2219 2219 2393 (174) 2219

AVIVA 2016-17 133651 (5413) 48281 53927 (11452) 22120 361 9963 251438 3528 29033 74 1673 34307 160231 109 55399 147 (8629) 207257 9874 9874 8541 1333 9874 Figures in brackets represents negative values

2015-16 149315 (5296) 47859 25211 (20863) (31279) 412 10386 175744 4205 34590 302 1697 40794 174219 95 (39357) (816) (4816) 129325 5625 5625 5923 (299) 5625

2014-15 179625 (5387) 43503 83083 (5407) 20989 262 25730 342399 7780 35434 58 1894 45167 177378 75 203279 (105886) 274846 22386 22386 21673 713 22386

2013-14 187810 (4855) 38736 56559 (32663) 17804 0 201 26951 290543 7781 40756 143 2289 50968 192075 340 47919 (26100) 214234 25341 25341 25714 (372) 25341

PARTICULARS Premiums earned – net Premium (a) Reinsurance ceded (b) Reinsurance accepted (c) Income from Investments Interest, Dividends & Rent – Gross (a) Profit on sale/redemption of investments (b) (c) (Loss on sale/ redemption of investments) Transfer/Gain on revaluation/change in fair value (d) Amortization of Premium/Discount on Investments (e) Appropriation/Expropriation Adjustment Account (f) Unrealised Gains/Loss Other Income T

88