Page 93 - Insurance Statistics 2021

P. 93

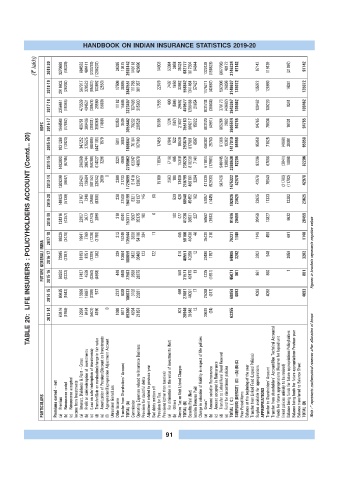

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

(? lakh) 2019-20 3270689 (48329) 684532 484411 (233793) (1266237) 24395 10475 2926142 149118 426690 14903 53084 3658 35324 682777 1817304 84844 1322439 (158828) (967706) 48172 2146224 97142 97142 119139 (21997) 97142

2018-19 2918602 (26202) 567917 328523 (95031) 103892 (2553) 17506 30895 3843551 111768 381357 22679 7407 1650 33982 558842 1341464 57427 1175211 (43667) 592306 26896 3149637 135072 135072 120690 14381 135072

2017-18 2356441 (19345) 473539 404531 (38578) 25580 (5609) 11182 15665 3223407 107493 315930 17555 490 (584) 29692 470577 1289488 21654 1031738 (38004) 379173 (40682) 2643367 109462 109462 100220 9241 109462

HDFC 2016-17 1944549 (17062) 406761 389406 (39001) 358366 (1468) 10353 3539 3055442 79202 238528 15198 1224 (597) 21607 355163 984217 15822 803120 (4991) 805264 2082 2605514 94765 94765 78634 16131 94765

TABLE 20: LIFE INSURERS : POLICYHOLDERS ACCOUNT (Contd... 20)

2015-16 1631298 (13420) 347252 375525 (98494) (447105) 1879 5911 3800 1806647 70184 187183 17455 (204) 522 18539 293679 817691 6507 486382 25763 61366 19302 1417010 95958 95958 71825 (4868) 29001 95958

2014-15 1482990 (6745) 286068 380744 (59208) 614027 3296 3221 4669 2709062 62347 148879 11934 (716) 465 15318 238226 816239 7141 511914 (17961) 940445 130852 2388630 82206 82206 67086 (3841) 18960 82206

2013-14 1206290 (8647) 235421 129694 (88152) 228342 2030 0 2388 21733 1729099 51410 128077 15160 2563 188 13400 210799 466191 3294 471339 (52930) 587428 1475322 42978 42978 76540 (21780) (11782) 42978

2019-20 148025 (5139) 27167 7349 (2568) (8380) 239 27508 194199 5321 62137 145 (0) 520 426 68548 45452 162 57857 (1445) 102026 23625 23625 11333 12292 23625

2018-19 124316 (4357) 22857 3677 (2743) 2999 318 6044 153111 5097 35375 100 6 180 477 41236 36531 227 56562 (1903) 91416 20459 20459 13827 6632 20459

2017-18 99229 (3478) 19941 7769 (1220) (3158) 212 16249 135544 3308 54189 204 11 455 58166 40436 46 35439 310 76231 1148 1148 456 691 1148

FUTURE GENERALI INDIA 2016-17 2015-16 73985 59250 (3197) (2322) 18153 17437 8751 4538 (1289) (3350) 1262 (4968) 329 448 10664 6468 108659 77503 3422 2638 36468 28375 123 122 416 558 40551 31571 40250 42475 12 13 23488 4235 1157 (1651) 64906 45071 3202 861 3202 861 546 860 2656 1 3202 861 Figures in brackets represents negative values

2014-15 60425 (1642) 15599 18697 (2399) 577 2737 6038 100033 3102 23281 698 27081 44091 17 25068 (317) 68859 4093 4093 4093 4093

2013-14 63416 (1959) 12958 8424 (5507) 4190 0 1069 6611 89200 4294 21851 801 26946 31648 12 30619 (24) 62255

PARTICULARS Premiums earned – net Premium (a) Reinsurance ceded (b) Reinsurance accepted (c) Income from Investments Interest, Dividends & Rent – Gross (a) Profit on sale/redemption of investments (b) (c) (Loss on sale/ redemption of investments) Transfer/Gain on revaluation/change in fair value (d) Amortization of Premium/Discount on Investments (e) Appropriation/Expropriation Adjustment Account (f) Unrealised Gains/Loss Other Income

91