Page 24 - James

P. 24

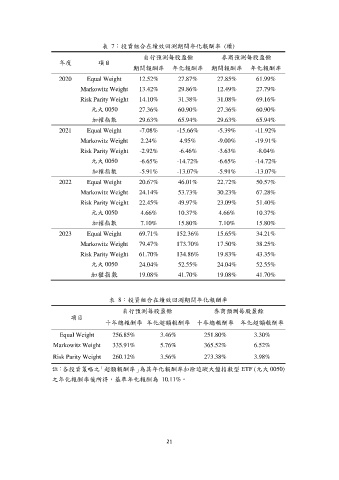

表 7:投資組合在績效回測期間年化報酬率 (續)

自行預測每股盈餘 券商預測每股盈餘

年度 項目

期間報酬率 年化報酬率 期間報酬率 年化報酬率

2020 Equal Weight 12.52% 27.87% 27.85% 61.99%

Markowitz Weight 13.42% 29.86% 12.49% 27.79%

Risk Parity Weight 14.10% 31.38% 31.08% 69.16%

元大 0050 27.36% 60.90% 27.36% 60.90%

加權指數 29.63% 65.94% 29.63% 65.94%

2021 Equal Weight -7.08% -15.66% -5.39% -11.92%

Markowitz Weight 2.24% 4.95% -9.00% -19.91%

Risk Parity Weight -2.92% -6.46% -3.63% -8.04%

元大 0050 -6.65% -14.72% -6.65% -14.72%

加權指數 -5.91% -13.07% -5.91% -13.07%

2022 Equal Weight 20.67% 46.01% 22.72% 50.57%

Markowitz Weight 24.14% 53.73% 30.23% 67.28%

Risk Parity Weight 22.45% 49.97% 23.09% 51.40%

元大 0050 4.66% 10.37% 4.66% 10.37%

加權指數 7.10% 15.80% 7.10% 15.80%

2023 Equal Weight 69.71% 152.36% 15.65% 34.21%

Markowitz Weight 79.47% 173.70% 17.50% 38.25%

Risk Parity Weight 61.70% 134.86% 19.83% 43.35%

元大 0050 24.04% 52.55% 24.04% 52.55%

加權指數 19.08% 41.70% 19.08% 41.70%

表 8:投資組合在績效回測期間年化報酬率

自行預測每股盈餘 券商預測每股盈餘

項目

十年總報酬率 年化超額報酬率 十年總報酬率 年化超額報酬率

Equal Weight 256.85% 3.46% 251.80% 3.30%

Markowitz Weight 335.91% 5.76% 365.52% 6.52%

Risk Parity Weight 260.12% 3.56% 273.38% 3.98%

註:各投資策略之「超額報酬率」為其年化報酬率扣除追蹤大盤指數型 ETF (元大 0050)

之年化報酬率後所得,基準年化報酬為 10.11%。

21