Page 631 - Microeconomics, Fourth Edition

P. 631

c15riskandinformation.qxd 8/16/10 11:10 AM Page 605

$1,900

$1,800

$1,700

$1,600

$1,500

$1,400

Value of $1,000 investment $1,100

$1,300

$1,200

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$50

9/1/1999 3/1/2000 9/1/2000 3/1/2001 9/1/2001 3/1/2002 9/1/2002 3/1/2003 9/1/2003 3/1/2004 9/1/2004 3/1/2005 9/1/2005 3/1/2006 9/1/2006 3/1/2007 9/1/2007 3/1/2008 9/1/2008 3/1/2009 9/1/2009 3/1/2010

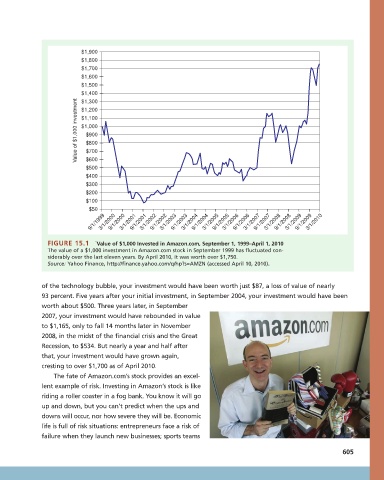

FIGURE 15.1 `Value of $1,000 Invested in Amazon.com, September 1, 1999–April 1, 2010

The value of a $1,000 investment in Amazon.com stock in September 1999 has fluctuated con-

siderably over the last eleven years. By April 2010, it was worth over $1,750.

Source: Yahoo Finance, http://finance.yahoo.com/q/hp?s=AMZN (accessed April 10, 2010).

of the technology bubble, your investment would have been worth just $87, a loss of value of nearly

93 percent. Five years after your initial investment, in September 2004, your investment would have been

worth about $500. Three years later, in September

2007, your investment would have rebounded in value

to $1,165, only to fall 14 months later in November

2008, in the midst of the financial crisis and the Great

Recession, to $534. But nearly a year and half after

that, your investment would have grown again,

cresting to over $1,700 as of April 2010.

The fate of Amazon.com’s stock provides an excel-

lent example of risk. Investing in Amazon’s stock is like

riding a roller coaster in a fog bank. You know it will go

up and down, but you can’t predict when the ups and

downs will occur, nor how severe they will be. Economic

life is full of risk situations: entrepreneurs face a risk of

failure when they launch new businesses; sports teams

605