Page 18 - CCFA Journal - Fourth Issue

P. 18

CCFA DSS 卓越领军 加中金融

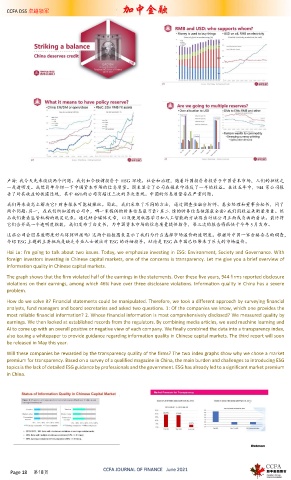

卢海: 我今天先来谈谈两个问题。我们如今强调投资于 ESG 环境、社会和治理,随着外国投资者投资于中国资本市场,人们的担忧之

一是透明度。我想简单介绍一下中国资本市场的信息质量。图表显示了公司在报表中违反了一半的收益。在这五年中,944 家公司报

告了对其收益的披露违规,其中 46%的公司有超过三次的多次违规。中国的信息质量存在严重问题。

我们再来谈怎么解决它? 财务报表可能被操纵。因此,我们采取了不同的方法,通过调查金融分析师、基金经理和董事会秘书,问了

两个问题: 其一,在我们所知道的公司中,哪一家提供的财务信息最可靠? 其二. 谁的财务信息披露最全面? 我们用收益来衡量质量。然

后我们查看监管机构的既定记录。通过结合媒体文章,以及使用机器学习和人工智能的方法得出对该公司正面或负面的看法。最终将

它们合并成一个透明度指数,我们发布了白皮书,为中国资本市场的信息质量提供指导,第三次的报告将很快于今年 5 月发布。

这些公司会因其透明度好而得到回报吗? 这两个指数图表显示了我们为什么选择市场溢价的透明度。根据对中国一家合格杂志的调查,

介绍 ESG 主题的主要挑战是缺乏专业人士做出对 ESG 的详细指导。结论是 ESG 在中国已经带来了巨大的市场溢价。

Hai Lu: I’m going to talk about two issues. Today, we emphasize investing in ESG: Environment, Society and Governance. With

foreign investors investing in Chinese capital markets, one of the concerns is transparency. Let me give you a brief overview of

information quality in Chinese capital markets.

The graph shows that the firm violated half of the earnings in the statements. Over these five years, 944 firms reported disclosure

violations on their earnings, among which 46% have over three disclosure violations. Information quality in China has a severe

problem.

How do we solve it? Financial statements could be manipulated. Therefore, we took a different approach by surveying financial

analysts, fund managers and board secretaries and asked two questions. 1: Of the companies we know, which one provides the

most reliable financial information? 2. Whose financial information is most comprehensively disclosed? We measured quality by

earnings. We then looked at established records from the regulators. By combining media articles, we used machine learning and

AI to come up with an overall positive or negative view of each company. We finally combined the data into a transparency index,

also issuing a whitepaper to provide guidance regarding information quality in Chinese capital markets. The third report will soon

be released in May this year.

Will these companies be rewarded by the transparency quality of the firms? The two index graphs show why we chose a market

premium for transparency. Based on a survey of a qualified magazine in China, the main burden and challenges to introducing ESG

topics is the lack of detailed ESG guidance by professionals and the government. ESG has already led to a significant market premium

in China.

CCFA JOURNAL OF FINANCE June 2021

Page 18 第18页