Page 36 - CCFA Journal - Tenth Issue

P. 36

经济论坛 Economics Forum 加中金融

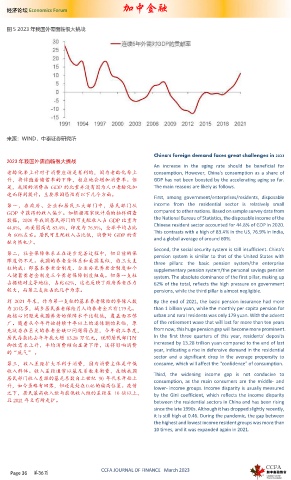

图 5 2023 年我国外需面临很大挑战

来源:WIND,中泰证券研究所

China's foreign demand faces great challenges in 2023

2023 年我国外需面临很大挑战

An increase in the aging rate should be beneficial for

老龄化率上升对于消费应该是有利的,因为老龄化率上 consumption, However, China's consumption as a share of

升,将伴随着储蓄率的下降,相应地会增加消费率。但 GDP has not been boosted by the accelerating aging so far.

是,我国的消费占 GDP 的比重并没有因为人口老龄化加 The main reasons are likely as follows.

速而得到提升。主要原因恐怕有以下几个方面。

First, among government/enterprises/residents, disposable

第一,在政府、企业和居民三大部门中,居民部门从 income from the residential sector is relatively small

GDP 中获得的收入偏少。如根据国家统计局的抽样调查 compared to other nations. Based on sample survey data from

数据,2020 年我国居民部门的可支配收入占 GDP 比重为 the National Bureau of Statistics, the disposable income of the

44.8%,而美国高达 83.4%,印度为 76.9%,全球平均占比 Chinese resident sector accounted for 44.8% of GDP in 2020.

为 60%左右。居民可支配收入占比低,消费对 GDP 的贡 This contrasts with a high of 83.4% in the US, 76.9% in India,

and a global average of around 60%.

献自然也少。

Second, the social security system is still insufficient. China's

第二,社会保障体系正在逐步完善过程中,但目前的保 pension system is similar to that of the United States with

障度仍不足。我国的养老金体系和美国类似,由三大支 three pillars: the basic pension system/the enterprise

柱构成:即基本养老金制度、企业补充养老金制度和个 supplementary pension system/the personal savings pension

人储蓄养老金制度三个养老保障制度组成。但第一支柱 system. The absolute dominance of the first pillar, making up

占据绝对主导地位,占比62%,这也反映了政府养老压力 62% of the total, reflects the high pressure on government

较大,而第三支柱占比几乎为零。 pensions, while the third pillar is almost negligible.

到 2021 年末,作为第一支柱的基本养老保险的参保人数 By the end of 2021, the basic pension insurance had more

为 10亿多,城乡居民养老保险月人均养老金只有179元。 than 1 billion yuan, while the monthly per capita pension for

故核心问题是我国养老的保障水平比较低,覆盖面不够 urban and rural residents was only 179 yuan. With the advent

广。随着从今年开始持续十年以上的退休潮的来临,原 of the retirement wave that will last for more than ten years

先就存在巨大的养老金缺口问题将凸显,今年前三季度, from now, this huge pension gap will become more prominent.

居民存款比去年年底大增 13.28 万亿元,说明居民部门防 In the first three quarters of this year, residents' deposits

御性需求上升,平均消费倾向显著下降,这将影响消费 increased by 13.28 trillion yuan compared to the end of last

的“底气” 。 year, indicating a rise in defensive demand in the residential

sector and a significant drop in the average propensity to

第三,收入差距扩大不利于消费,因为消费主体是中低 consume, which will affect the "confidence" of consumption.

收入群体。收入差距通常以基尼系数来衡量,反映我国 Third, the widening income gap is not conducive to

居民部门收入差距的基尼系数自上世纪 90 年代末开始上 consumption, as the main consumers are the middle- and

升,如今虽略有回落,但还是处在0.46的偏高位置。疫情 lower- income groups. Income disparity is usually measured

之下,居民最高收入组与最低收入组的差距在 10 倍以上, by the Gini coefficient, which reflects the income disparity

且 2021 年又有所走扩。 between the residential sectors in China and has been rising

since the late 1990s. Although it has dropped slightly recently,

it is still high at 0.46. During the pandemic, the gap between

the highest and lowest income resident groups was more than

10 times, and it was expanded again in 2021.

CCFA JOURNAL OF FINANCE March 2023

Page 36 第36页