Page 42 - CCFA Journal - Third Issue

P. 42

加中金融

风控大讲堂 Risk Management Forum 加中金融

表 1:所有银行(百分比)来源:巴塞尔银行监管委员会

Table 1: All banks, in percentage Source: Bank Committee on Banking Supervision (BCBS)

3.2 FRTB 对全球市场的影响 3.2 FRTB impact to global markets

FRTB 将对不同的资产类别,市场和产品带来不同的影响。 FRTB will pose different impacts to different asset classes,

markets and products. Given the fact that securitized products

由于证券化产品在 2007-09 年全球金融危机期间的带来巨

are not allowed for internal model approach due to its loss

大的损失,其模型及数据可靠性较其他产品差,因此不允

during the global financial crisis in 2007-09, it is expected that

许对这类产品采用内部模型法。预计证券化产品将被要求

these products will have more RWA and less liquid markets in

有更多的风险权重资产。其市场的流动性也会随之降低。 general. Another type of products is structured products, where

另一类受影响的产品是结构性产品,其流动性期限可能更 its liquidity horizon might be longer and attract more regulatory

长,吸引更多的监管资本。因此,银行持有这些产品的意 capital. As a result, banks have less willingness to hold them.

愿降低了。最后,由于与流动性挂钩的风险权重上升,持 Finally, corporate bonds especially in the financial sector might

有公司债券(尤其是金融领域的公司债券)的成本可能会更 be expensive due to heightened risk weights tied to liquidity

horizon. This ultimately will cause more funding cost for

贵。这最终将给资本市场上的金融机构带来更高的融资成

本,以期有效防止资金在金融机构内空转。 financial institutions in capital markets.

3.3 FRTB 对银行 IT 基础设施的影响

3.3 FRTB impact to bank’s IT infrastructure

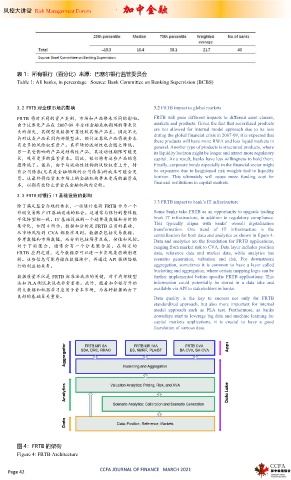

除了满足监管合规的要求,一些银行也将 FRTB 作为一个

升级交易账户 IT基础设施的机会。这通常与银行的整体数 Some banks take FRTB as an opportunity to upgrade trading

book IT infrastructure, in addition to regulatory compliance.

字化转型相一致。IT 基础设施的一个趋势是数据和分析的

This typically aligns with banks’ overall digitalization

集中化,如图 4 所示。数据和分析是 FRTB 应用的基础,

transformation. One trend of IT infrastructure is the

从市场风险到 CVA 都要涉及到。数据层包括交易数据、

centralization for both data and analytics as shown in figure 4.

参考数据和市场数据,而分析包括场景生成、估值和风控。 Data and analytics are the foundation for FRTB applications,

对于下游聚合,通常会有一个分类聚合层。在特定的 ranging from market risk to CVA. Data layer includes position

FRTB 应用之前,这个数据层可以进一步实现某些映射逻 data, reference data and market data, while analytics has

辑。这些信息可能存储在数据湖中,并通过 API 提供给银 scenario generation, valuation and risk. For downstream

行的利益相关者。 aggregation, sometimes it is common to have a layer called

bucketing and aggregation, where certain mapping logic can be

数据质量不仅是 FRTB 标准法成功的关键,对于内部模型 further implemented before specific FRTB applications. This

法如 PLA 测试来说也非常重要。此外,随着如今银行开始 information could potentially be stored in a data lake and

将大数据和机器学习应用于资本市场,为各种数据的打下 available via API to stakeholders in banks.

良好的基础至关重要。 Data quality is the key to success not only for FRTB

standardized approach, but also more important for internal

model approach such as PLA test. Furthermore, as banks

nowadays start to leverage big data and machine learning for

capital markets applications, it is crucial to have a good

foundation of various data.

图 4:FRTB 的架构

Figure 4: FRTB Architecture

CCFA JOURNAL OF FINANCE MARCH 2021

Page 42