Page 9 - AMANGO MODEL ANSWER 1

P. 9

P a g e | 9

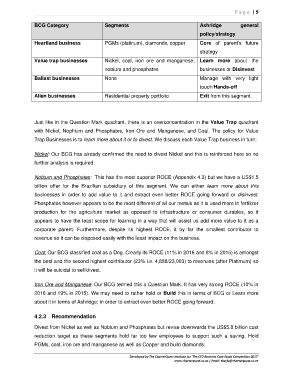

BCG Category Segments Ashridge general

policy/strategy

Heartland business PGMs (platinum), diamonds, copper Core of parent’s future

strategy

Value trap businesses Nickel, coal, iron ore and manganese, Learn more about the

nobium and phosphates businesses or Disinvest

Ballast businesses None Manage with very light

touch/Hands-off

Alien businesses Residential property portfolio Exit from this segment.

Just like in the Question Mark quadrant, there is an overconcentration in the Value Trap quadrant

with Nickel, Nophium and Phosphates, Iron Ore and Manganese, and Coal. The policy for Value

Trap Businesses is to learn more about it or to divest. We discuss each Value Trap business in turn:

Nickel: Our BCG has already confirmed the need to divest Nickel and this is reinforced here so no

further analysis is required.

Nobium and Phosphates: This has the most superior ROCE (Appendix 4.3) but we have a US$1.5

billion offer for the Brazilian subsidiary of this segment. We can either learn more about this

businesses in order to add value to it and extract even better ROCE going forward or disinvest.

Phosphates however appears to be the most different of all our metals as it is used more in fertilizer

production for the agriculture market as opposed to infrastructure or consumer durables, so it

appears to have the least scope for learning in a way that will assist us add more value to it as a

corporate parent. Furthermore, despite its highest ROCE, it by far the smallest contributor to

revenue so it can be disposed easily with the least impact on the business.

Coal: Our BCG classified coal as a Dog. Clearly its ROCE (11% in 2016 and 8% in 2015) is amongst

the best and the second highest contributor (23% i.e. 4,888/23,003) to revenues (after Platimum) so

it will be suicidal to sell/divest.

Iron Ore and Manganese: Our BCG termed this a Question Mark. It has very strong ROCE (10% in

2016 and 19% in 2015). We may need to rather hold or Build this in terms of BCG or Learn more

about it in terms of Ashridge; in order to extract even better ROCE going forward.

4.2.3 Recommendation

Divest from Nickel as well as Nobium and Phosphates but revise downwards the US$5.8 billion cost

reduction target as these segments hold far too few employees to support such a saving. Hold

PGMs, coal, iron ore and manganese as well as Copper and build diamonds.

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2017'

www.charterquest.co.za | Email: thecfo@charterquest.co.za