Page 225 - AR DPBM-2016--SMALL

P. 225

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

Struktur dan Organ Tata Kelola Dana Pensiun yang Baik

Good Pension Fund Governance Structure and Bodies

MeKaniSMe Dan HuBungan anTar Organ MECHANISMS AND RELATIONSHIPS BETWEEN BODIES

Struktur Tata Kelola Dana Pensiun dari DPBM sesuai dengan DPBM’s Pension Fund Governance Structure is in accordance with

Peraturan OJK No. 16/POJK.05/2016 tentang Pedoman Tata OJK Regulation No. No. 16/POJK.05/2016 regarding Guidelines for

Kelola Dana Pensiun, dimana organ Pendiri, Dewan Pengawas Pension Fund Governance, where the Founder, Supervisory Board

dan Pengurus memiliki peran dan fungsi masing-masing yang and the Managing Board have interrelated roles and functions with

saling terkait antara satu sama lain. Hubungan kerja Pendiri, Dewan each other. The Founder of the employment relationship and the

Pengawas dan Pengurus adalah hubungan check and balances Supervisory and Managing Boards are the checks and balances with

dengan tujuan akhir untuk kemajuan dan kesehatan DPBM. the ultimate goal of a progressive and healthy DPBM.

Pendiri dilarang melakukan intervensi terhadap kegiatan pengelolaan The Founder is prohibited from intervention in the pension fund

DPBM, dimana Pengurus harus bersikap independen dalam management activities, where the Managing Board should be

pengelolaan kegiatannya. Dewan Pengawas dan Pengurus sesuai independent in the management of its activities. The Supervisory

dengan fungsi masing-masing, berkewajiban melaksanakan antara Board and the Managing Board, in accordance with their respective

lain fungsi pengendalian internal dan manajemen risiko; pencapaian functions, maintain the continuity of the Pension Fund and are

imbal hasil (return) yang optimal; perlindungan kepentingan obliged to carry out, among others, the function of internal control

Pendiri dan Peserta secara wajar; kaderisasi kepemimpinan dan and risk management; the achievement of optimal yield (return) for

keberlangsungan manajemen; serta pelaksanaan GPFG dengan DPBM; the Founder protects the reasonable interests of members;

baik dan benar. Pengurus dan Dewan Pengawas, sesuai dengan visi the regeneration of leadership and management continuity; and

dan misi serta strategi yang telah ditetapkan, menyepakati Rencana proper Good Pension Fund Governance. The Managing Board and

Jangka Panjang serta Rencana Kerja dan Anggaran Tahunan. Supervisory Board, in accordance with the vision and mission, as well

as the strategies that have been established, agree on Long-Term

Plans and Annual Work Plans and Budgets.

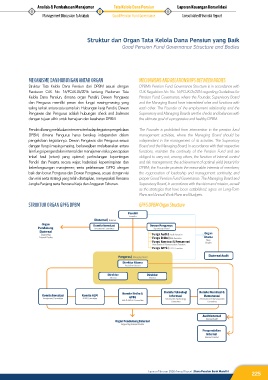

STruKTur Organ gPFg DPBM GPFG DPBM Organ Structure

Pendiri

Founder

eksternal | External

organ Komite Investasi Dewan Pengawas

Pendukung Investment Committee Supervisory Board

eksternal organ

Supporting Fungsi Audit | Audit Function

External Bodies Fungsi Risiko | Risk Function utama

Main

Fungsi Nominasi & Remunerasi Bodies

Nomination & Remuneration Function

Fungsi GPFG | GPFG Function

eksternal audit

Pengurus | Managing Board

Direktur utama

President Director

Direktur Direktur

Director Director

Komite risiko & Komite Teknologi Komite nominasi &

Komite Investasi Komite aLm Informasi remunerasi

Investment Committee ALM Committee GPfG Information Technology Nomination & Remuneration

Risk & GPFG Committee

Committee Committee

audit Internal

Internal Audit

organ Pendukung Internal

Supporting Internal Bodies

Pengendalian

Internal

Internal Control

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

225