Page 91 - QEB_2_2016_lowres

P. 91

3. About 20% of the WC’s exports to the UK are inputs into industry. Locally manufactured

exports used in the UK for the purpose of either maintenance or as inputs into the

production process, in short to medium term will not likely be affected. Inputs for the

purpose of new investments are likely to be impacted, and even then, the impact

will only relate to UK produced goods that are likely to be exported from the UK to

the EU. Much of the locally produced goods in the UK are locally consumed and not

exported to the EU.

Growth

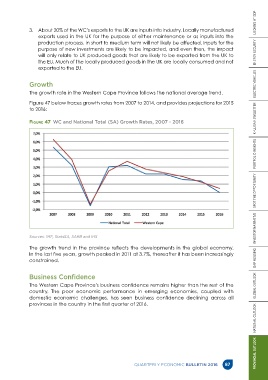

The growth rate in the Western Cape Province follows the national average trend.

Figure 47 below traces growth rates from 2007 to 2014, and provides projections for 2015

to 2016:

Figure 47 WC and National Total (SA) Growth Rates, 2007 - 2016

Sources: IMF, StatsSA, SARB and IHS PROVINCIAL OUTLOOK NATIONAL OUTLOOK GLOBAL OUTLOOK GAP HOUSING INVESTOR NARRATIVE SPOT THE OPPORTUNITY PORTFOLIO INSIGHTS KHULISA NEWSLETTER ELECTRIC VEHICLES ENERGY SECURITY LOOKING AT GDP

The growth trend in the province reflects the developments in the global economy.

In the last five years, growth peaked in 2011 at 3.7%, thereafter it has been increasingly

constrained.

Business Confidence

The Western Cape Province’s business confidence remains higher than the rest of the

country. The poor economic performance in emerging economies, coupled with

domestic economic challenges, has seen business confidence declining across all

provinces in the country in the first quarter of 2016.

QUARTERLY ECONOMIC BULLETIN 2016 87